By using this website, you agree to our Cookie Policy.

Attract and retain banking customers with frictionless delivery of

Value Added Services

Generate new revenue and keep customers engaged with

frictionless delivery, payment and usage of extra services.

Combine best-in-class services with accounts or cards,

embed services in the online or mobile banking app, offer

transactional services and much more.

Overview

Retail

Retain customers and monetise your customer relation to improve your bottom line

Wholesale

Deliver value to customers by combining extra services with premium accounts or cards

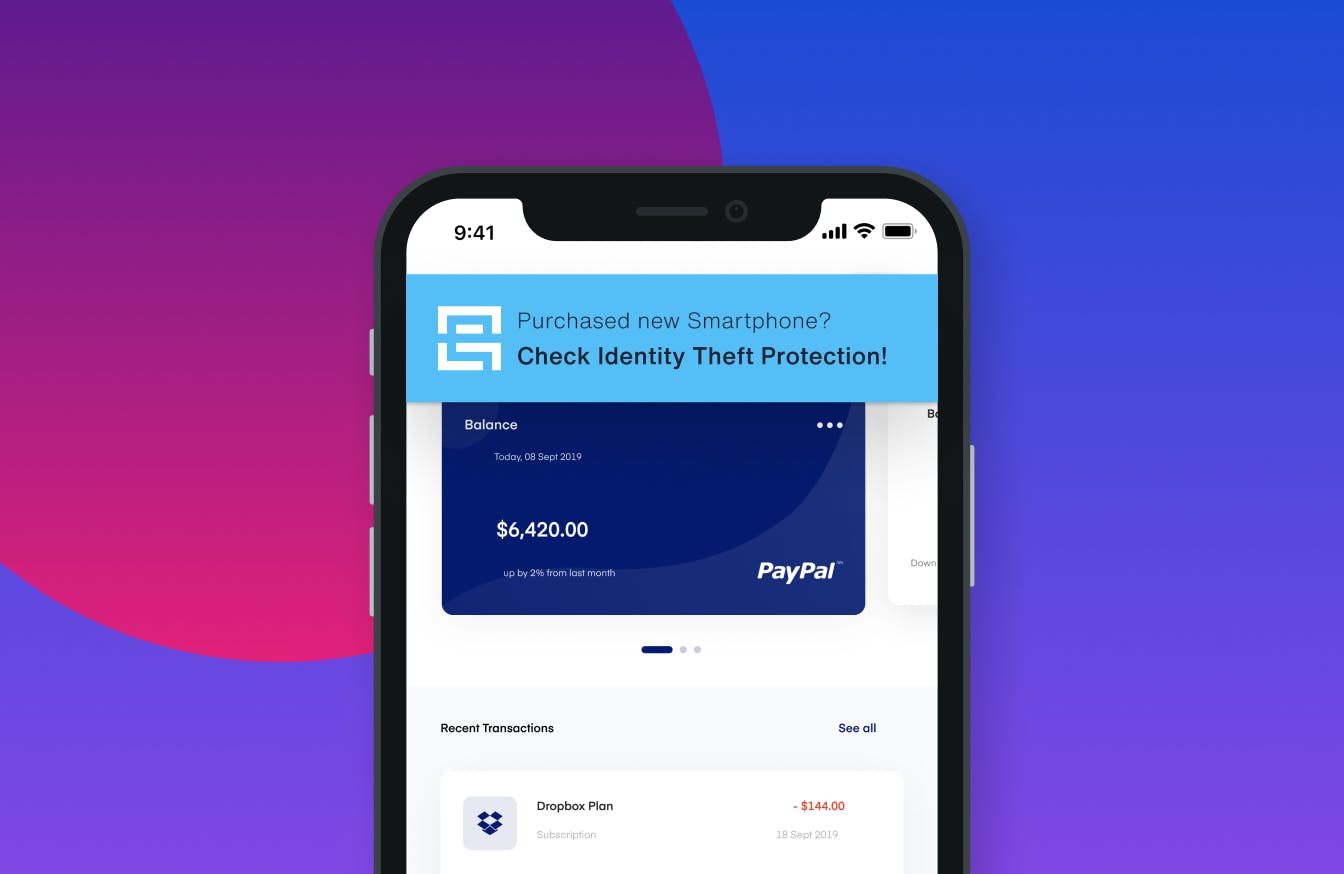

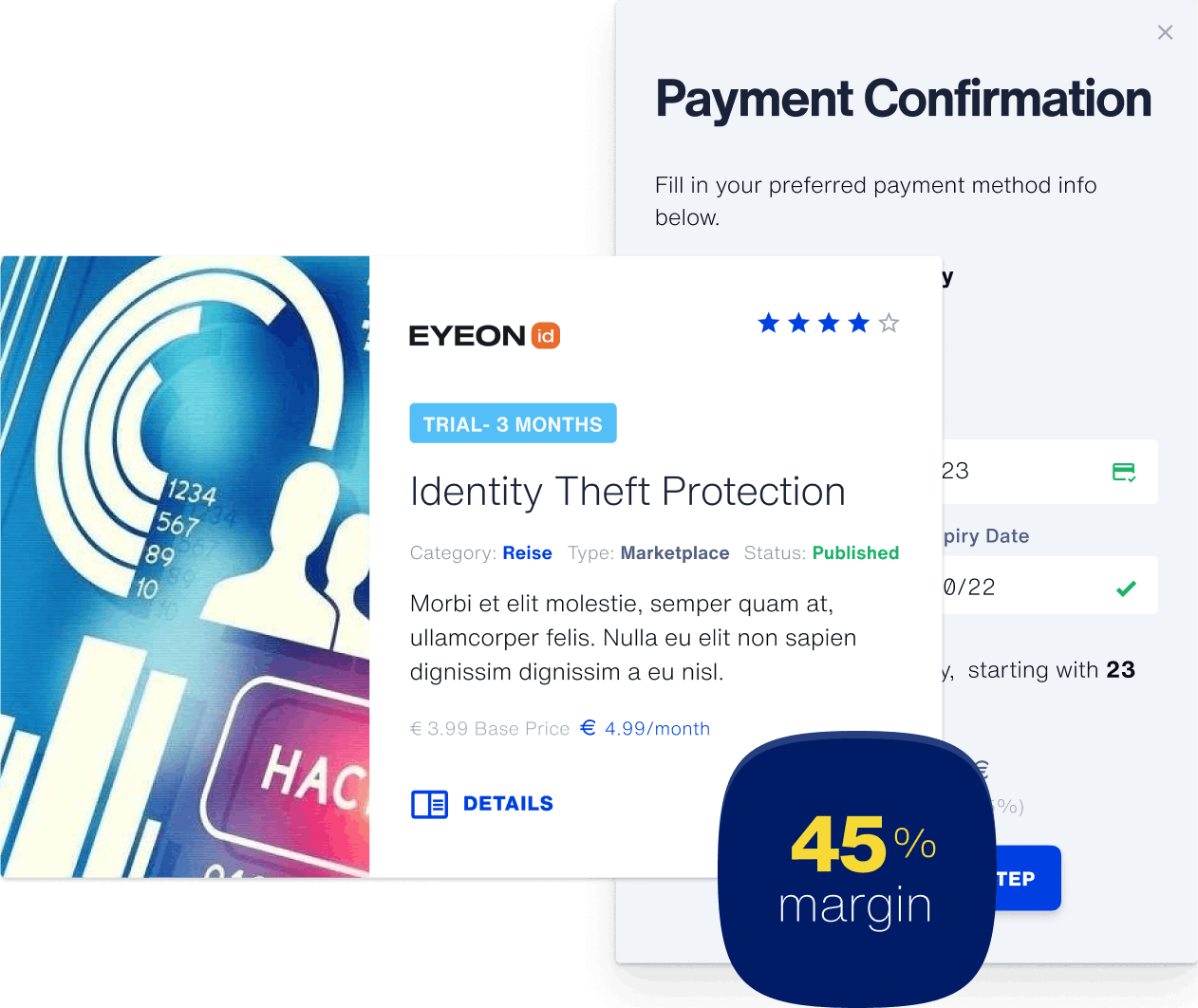

Transactional

Pair every transaction with a great service and create billions of new touch points

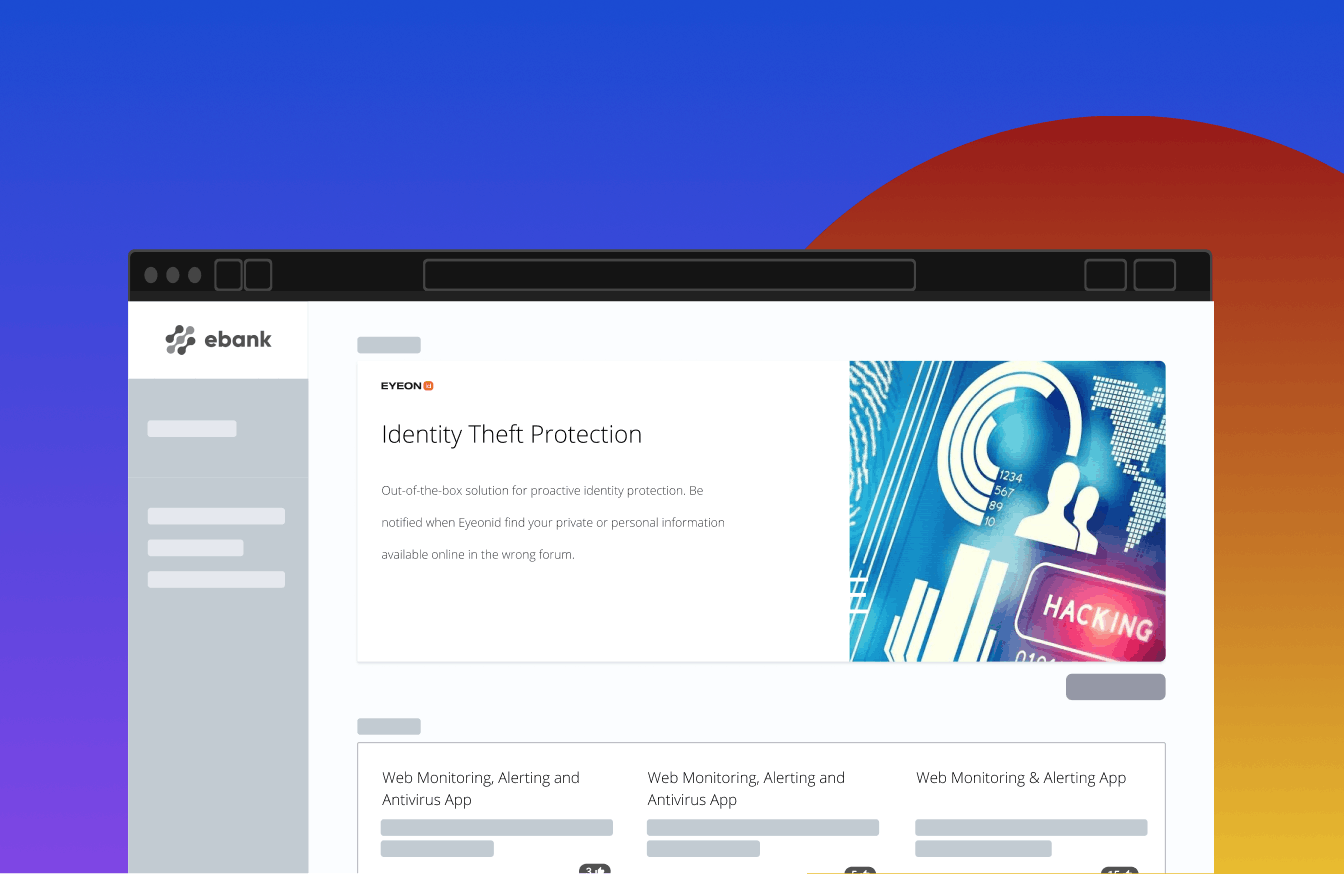

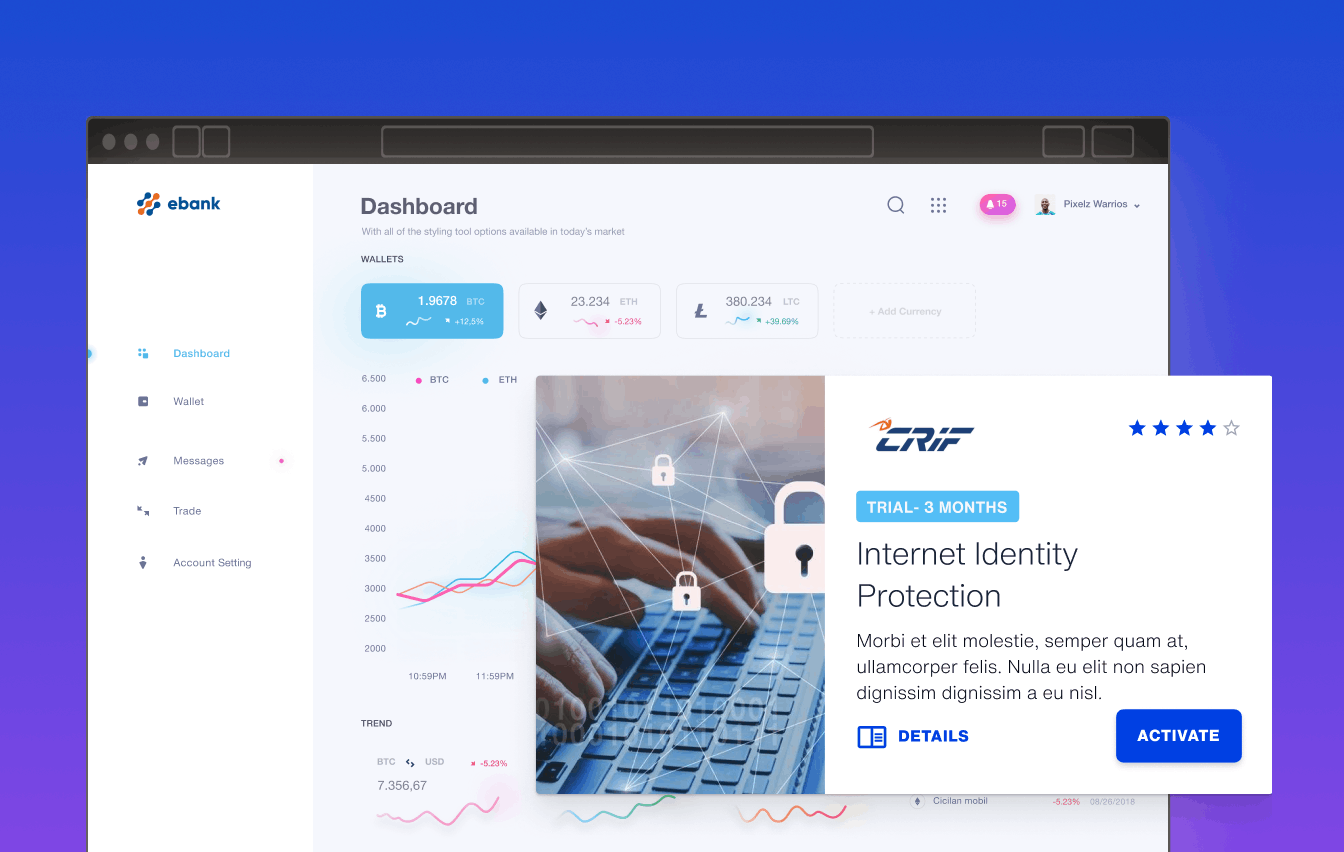

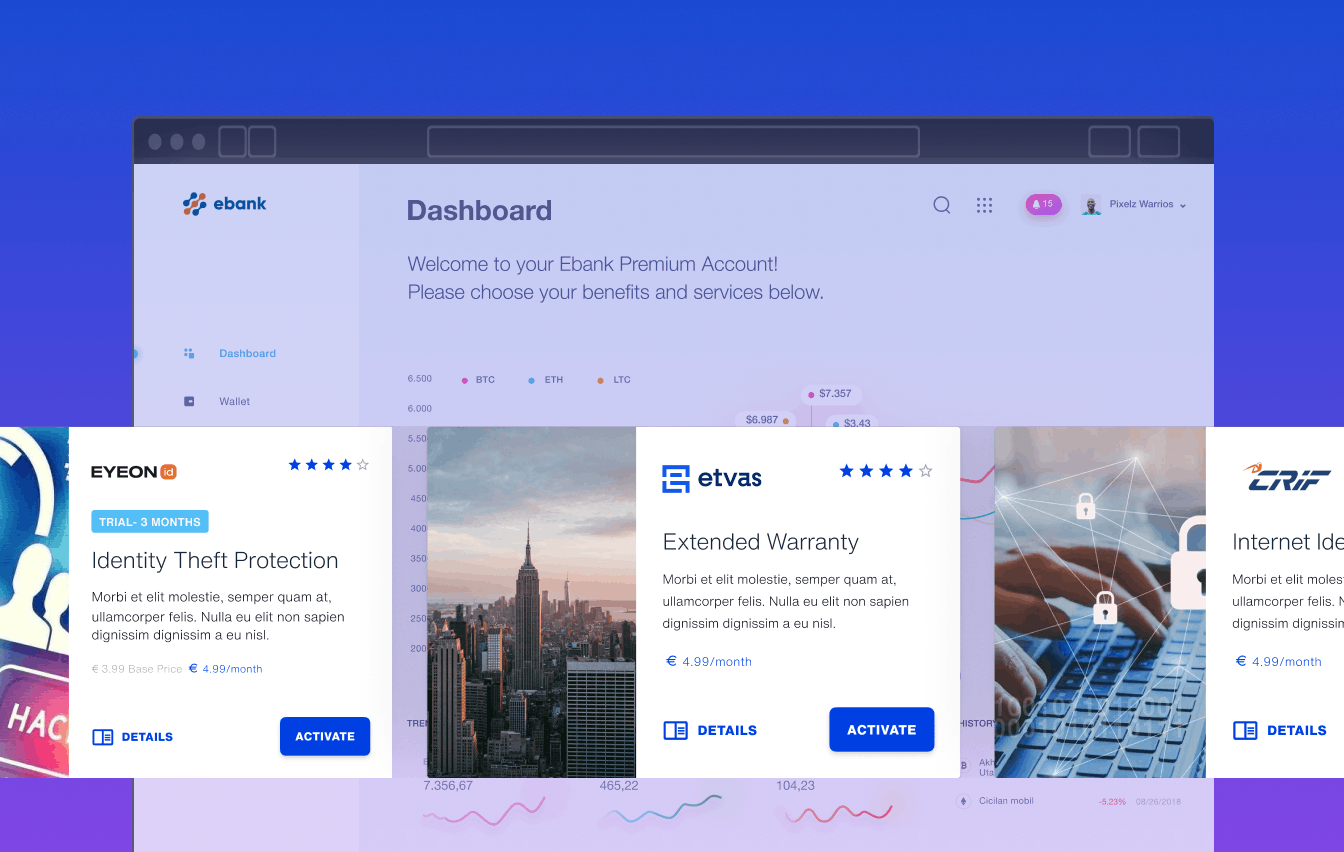

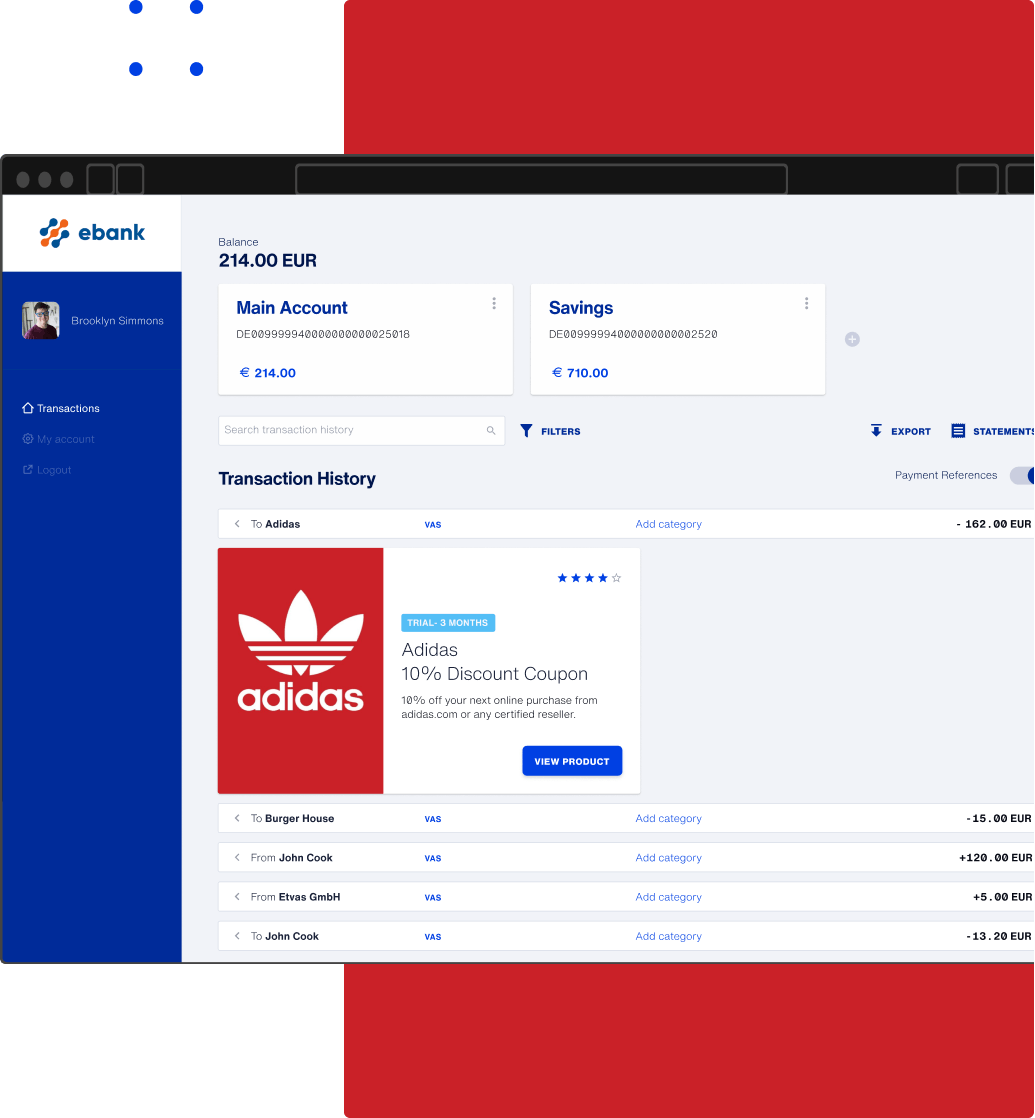

Integrated in online and mobile banking

Frictionless payment and usage of services inside the online banking app

Hosted white-label portal

"Zero IT" value added service delivery with Single Sign On and Single Payment

Social media campaigns

Test customer response in social media campaigns with service landing pages

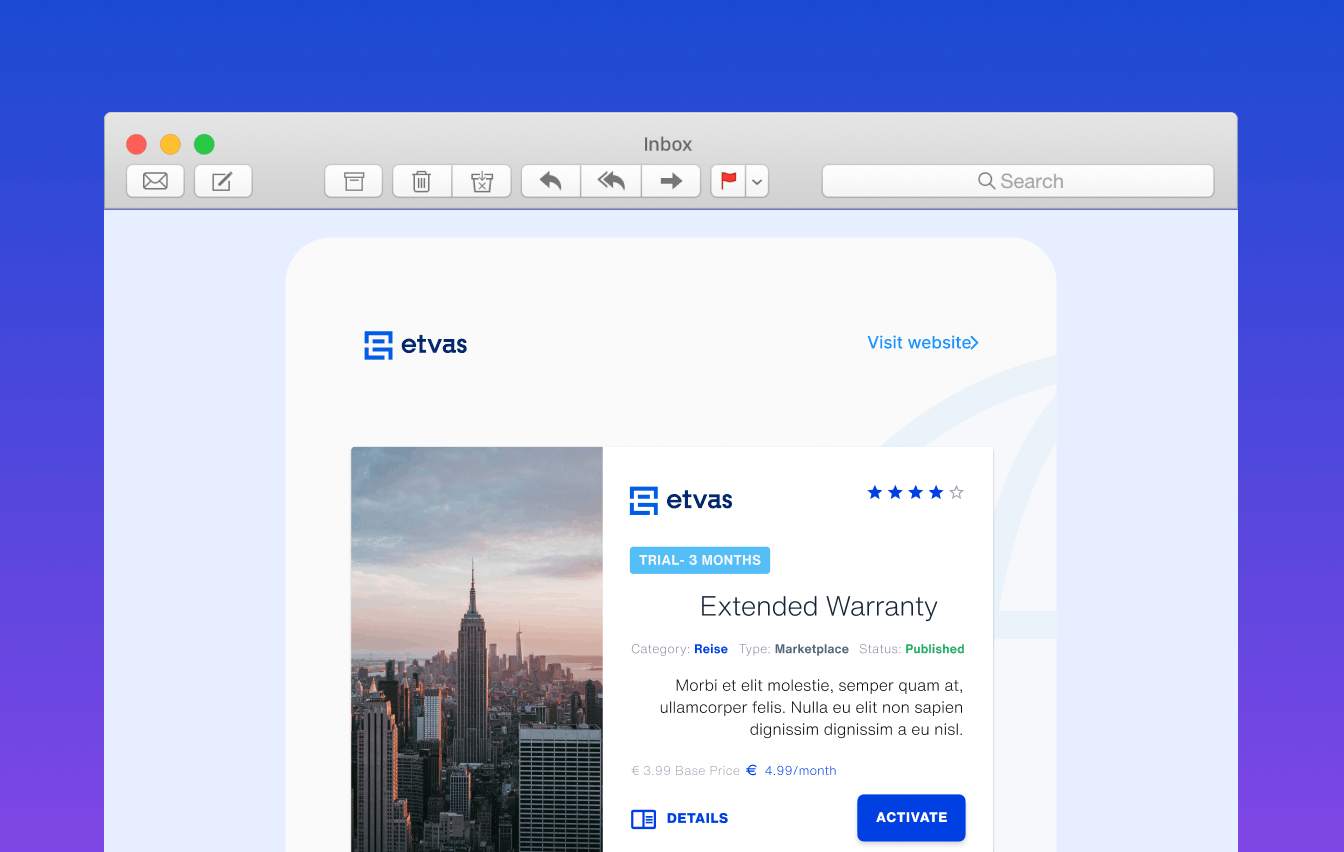

Newsletters

Run one off newsletter special offers with hosted and branded landing pages

Call center campaigns

Upsell or improve customer relations in the call center with relevant service offers

In branch sales

Sell extra services in the branch for full 360 degrees customer satisfaction

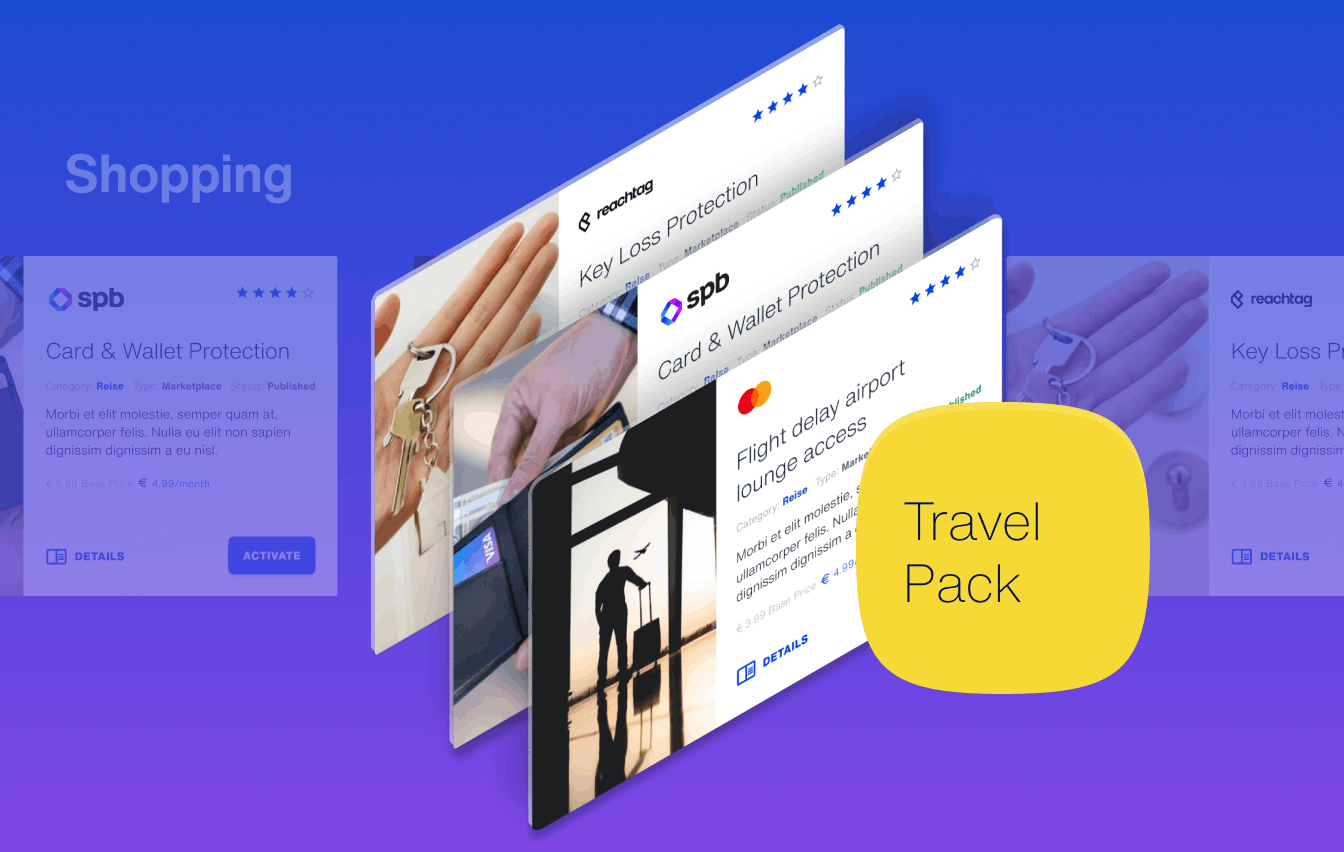

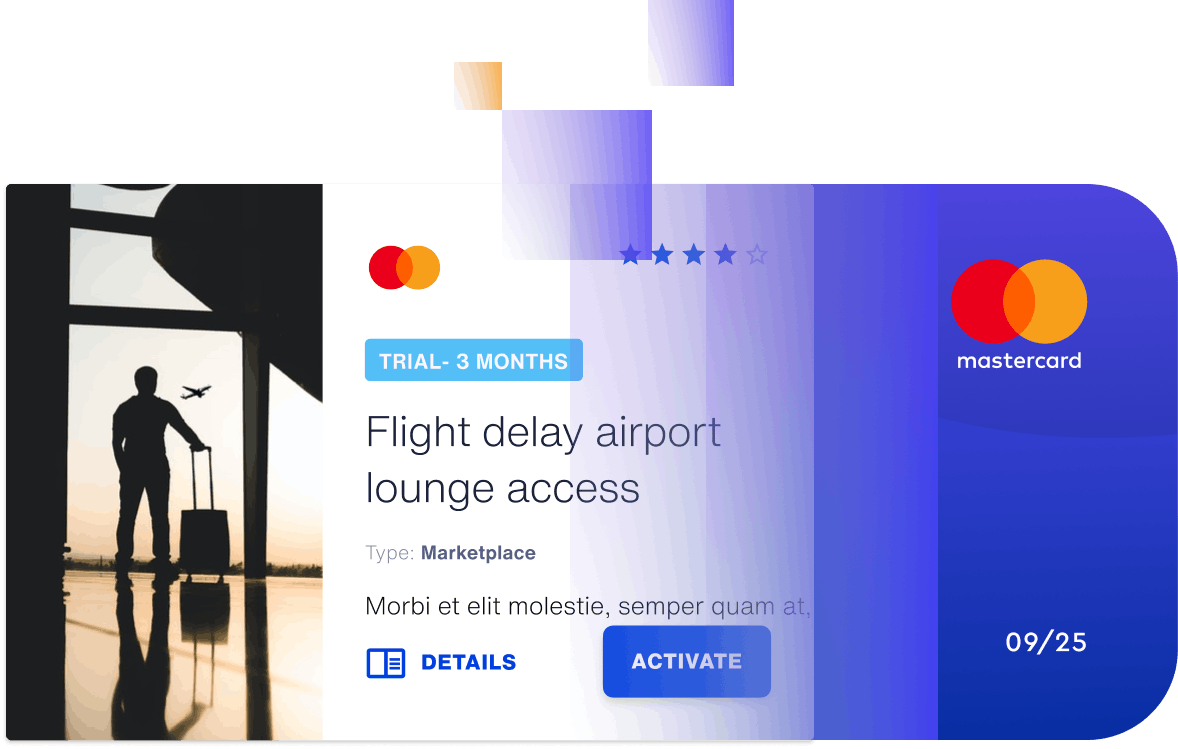

Bundle services with accounts or cards

Combine premium accounts or cards with services to value for customers

Card stickering

Present a service offer upon card delivery and use this touchpoint to upsell

Product packages

Combine multiple services and create unique service packs relevant for your customer segment

Card configurator

Disconnect service offers from "the plastic" and allow customers to choose relevant services

Trial product upselling on card issuing

Upsell by offering trial services when customers renew their cards

Card safe receipt

Upsell and generate new revenue when customers confirm their card safe receipt

"Value Added Services are a core pillar in our new strategy"

Pranjal Kothari

CDO & Board Member at Sparkasse Bremen

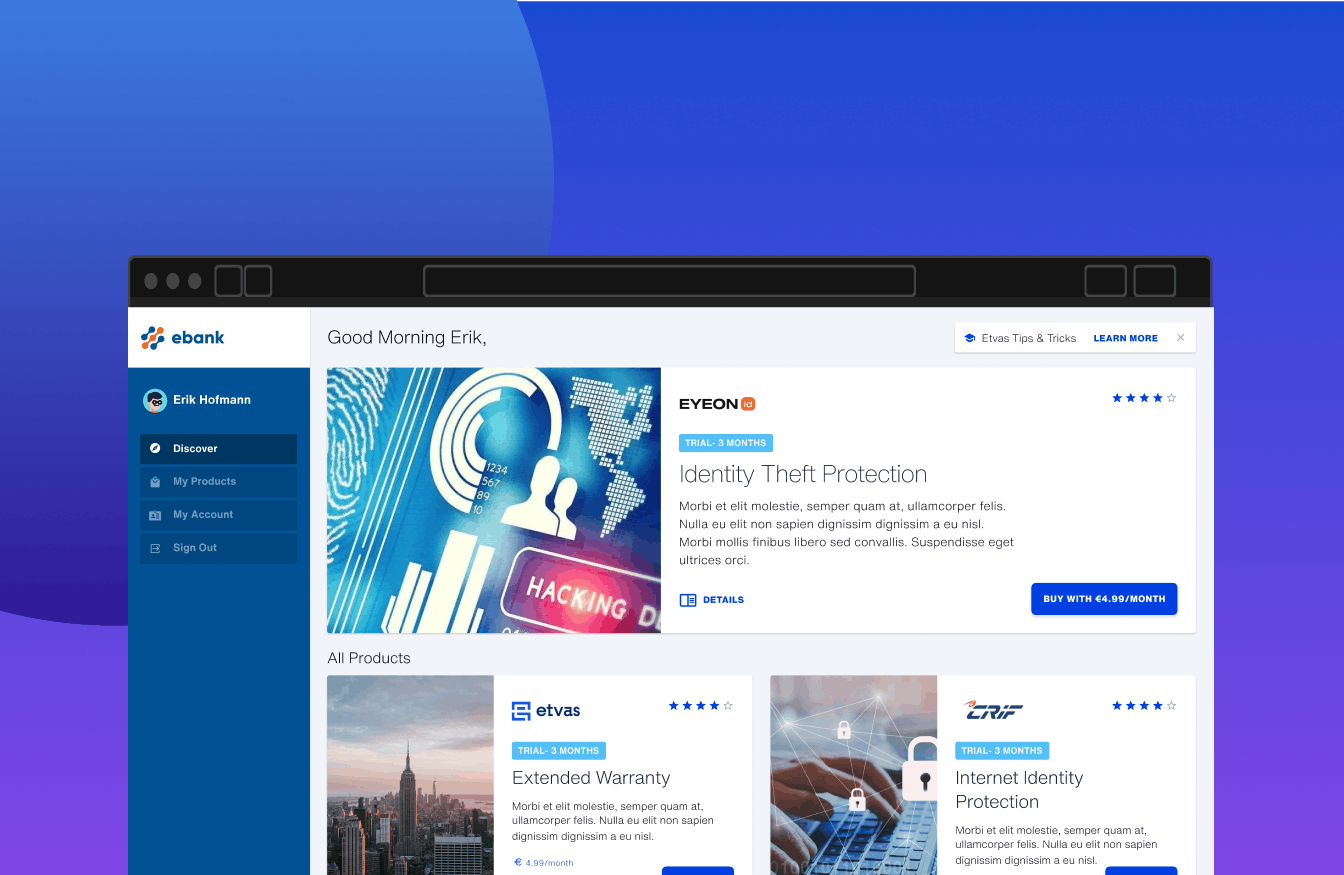

Etvas scenarios that offer real-world benefits

Offer convenient and affordable extra services to retain customers and stay competitive; - OR - Monetise your current customer base with extra services to improve your bottom line.

Integrate your own services or leverage the extra services available on the Etvas Marketplace

Discover powerful use cases with fantastic customer experience.

Retail - sell services for additional revenue

Add extra services to your current product offers - current accounts or with premium cards.

Directly integrated in your app, no payment process, zero friction.

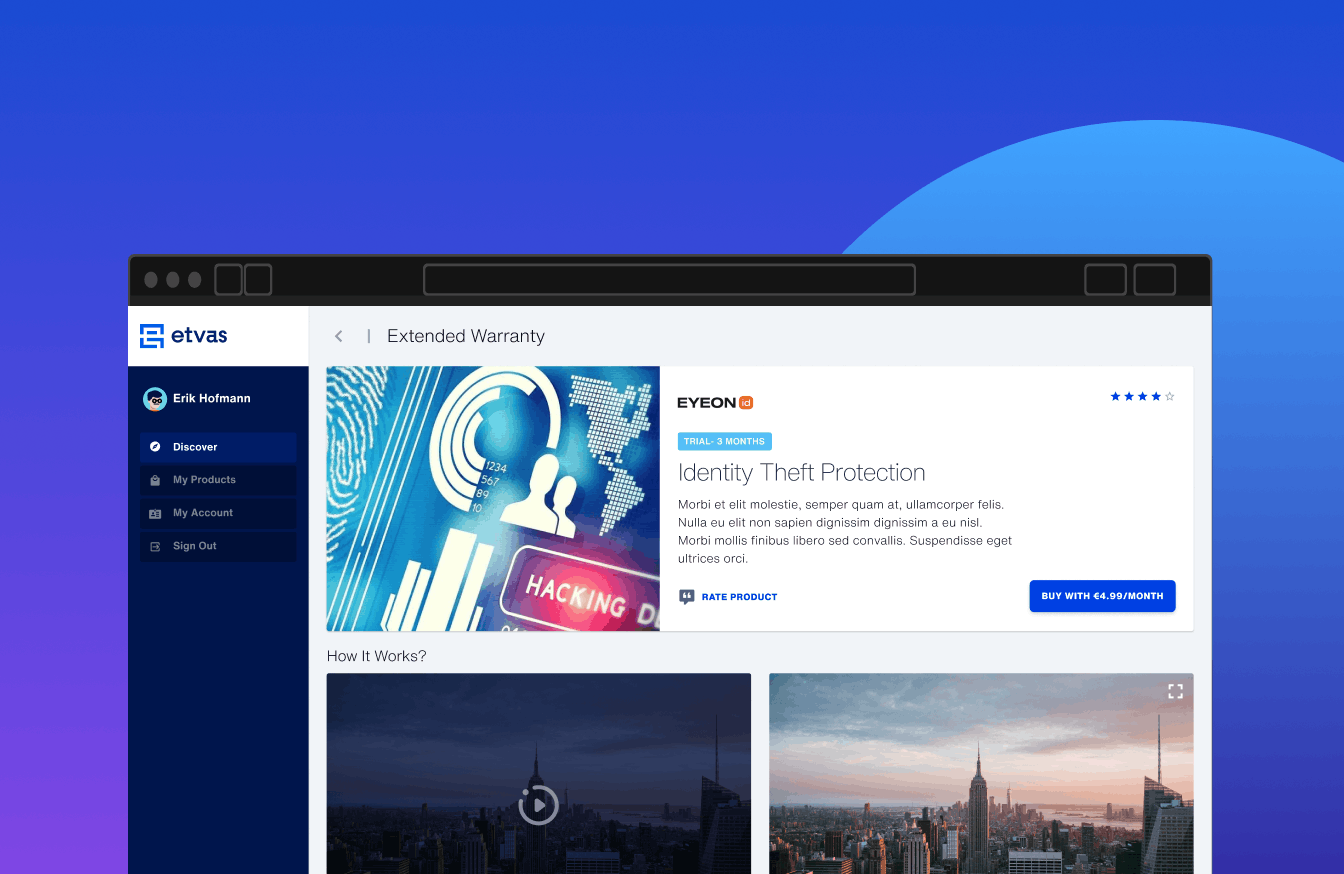

Wholesale - Combine services with products to retain customers

Become a market leader and deliver transactional and contextual value-added services to your customers based on their transaction data, directly inside the Online or Mobile banking app.

Transactional - Innovate at the cutting edge and pair the right service with each transaction

Etvas in cooperation with

Sparkasse Bremen

Discover how Etvas and Sparkasse Bremen work together to accelerate digital transformation with

frictionless delivery of extra services.

Learn how you can apply Etvas to offer more personalised services to your customers.

Core Etvas Use Cases

Value-added services are the new banking battleground

of customers expect extra services from their bank

of banking customers purchased at least one non banking service

of customers think the CX needs significant improvements

“Although Etvas supports a wide variety of pricing models in the market, customers experience the simplicity of a one-click payment and invoice aggregation process regardless of which service they decide to use.”

Sören Timm

Founder and Manager at Etvas

The challenges of building customer trust with value-added services

Procuring value-added services takes time and is error prone in a nontransparent market.

Contracting with value-added service providers is expensive and slow.

Due to limited IT resources and differences in technological maturity of service partners.

Meet the expectations of the young generation of digital customers!

Premium offerings will result in premium pricing. Offer more personalized services that will fit the lifestyle of the digital customer.

Add value to existing banking products with an intuitive platform that will help increase customer satisfaction and revenue.

Meet customer expectation for extraordinary digital customer experiences using the modern Etvas technology.

“Become an everyday life-coach to your customers, even outside the world of financial products. Offer suitable support, security, savings or unique experiences whenever and wherever your customers want it.”

Ilie ghiciuc

Founder & Manager @ Etvas

What else can I do with Etvas?

From the Etvas Zeitgeist Blog

How the most innovative banks in the world are using services and beyond banking products to win Gen X and Gen Z customers from traditional banks.