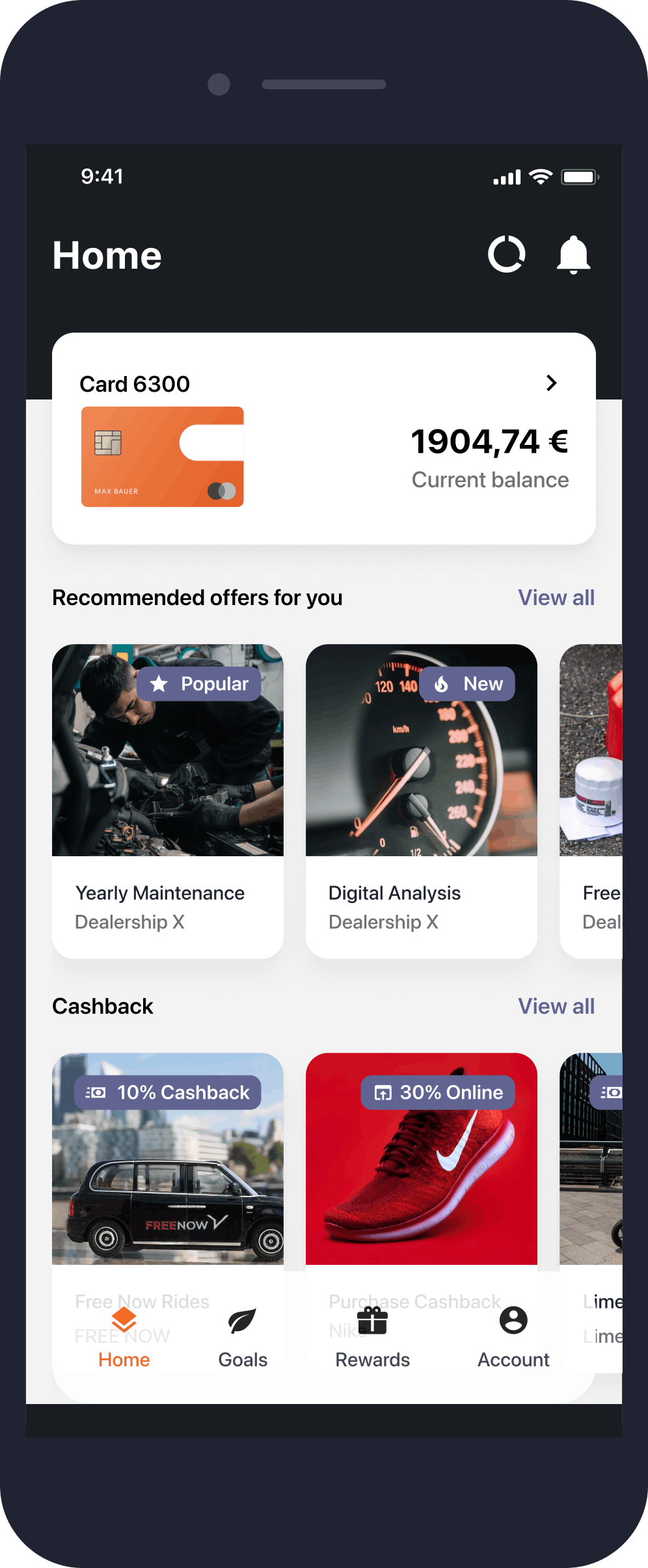

Cashback Offers

that are really worth it

Etvas Cashback successfully increases customer loyalty and facilitates customer acquisition for banks. Be one of the first banks to offer your customers relevant, personalized online and offline cashback offers.

Allow your customers to have a great customer journey now. The high level of customization creates unique customer experiences.

Cashback Offers from Etvas - zero costs, significant revenue

Cross your heart! How often have you used a cashback offer from your bank?

Usage rates are usually low because customers have no need for the service offered or they want to devote their time to something else. In addition to being irrelevant, cashback promotions are also unappealing. The customer journey is often inconsistent, as almost all solutions are based on affiliate marketing networks. Consumers have to log in to apps or third-party portals. A hurdle! Apart from the fact that every click is one click too many, consumers do not have the patience to find their way around yet another user interface. In general, customer expectations for convenience, personalization, experience and security are on the rise. With Etvas Cashback offers you can effectively meet this trend. For this purpose, you can choose from two cooperation models:

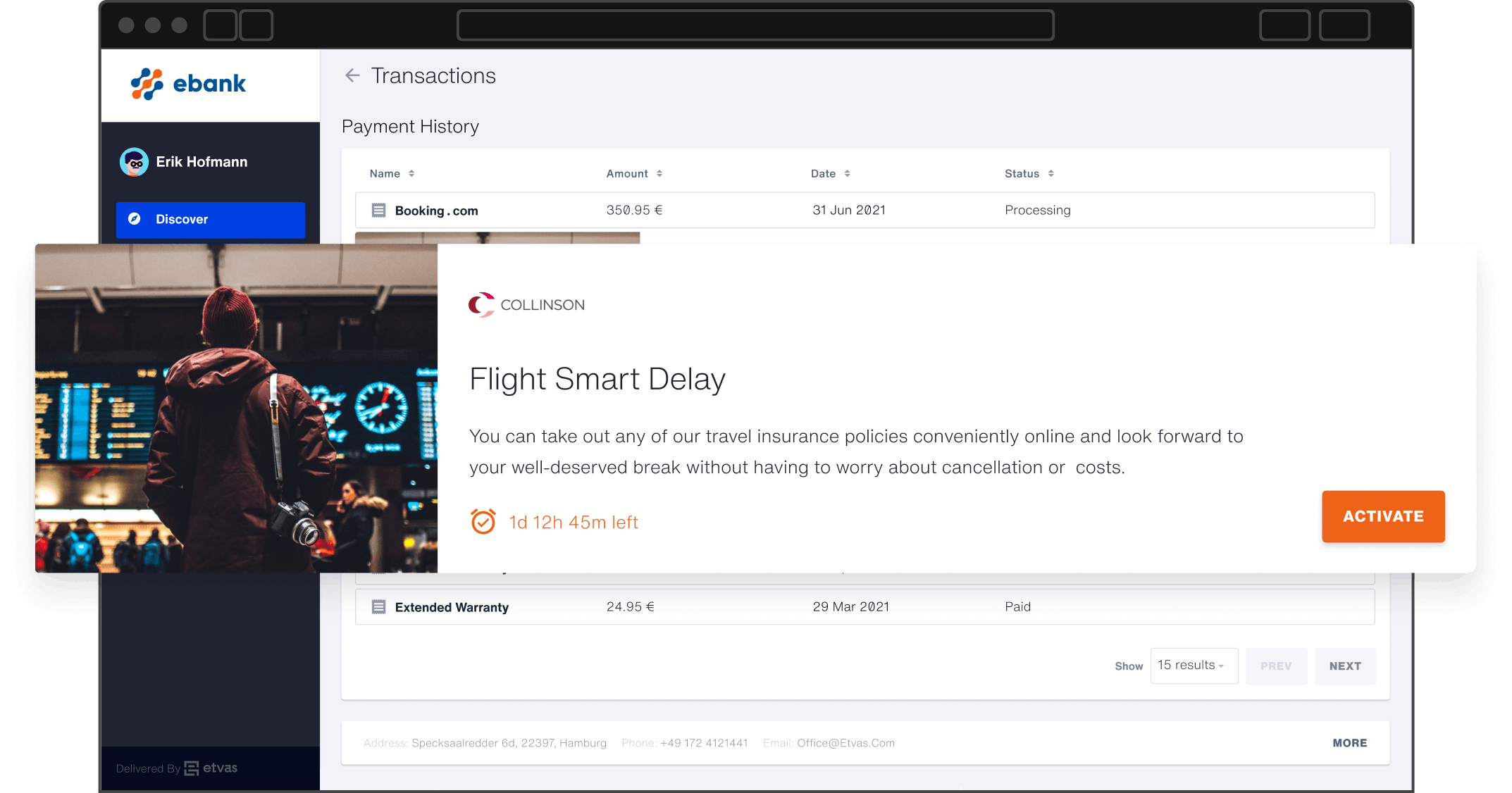

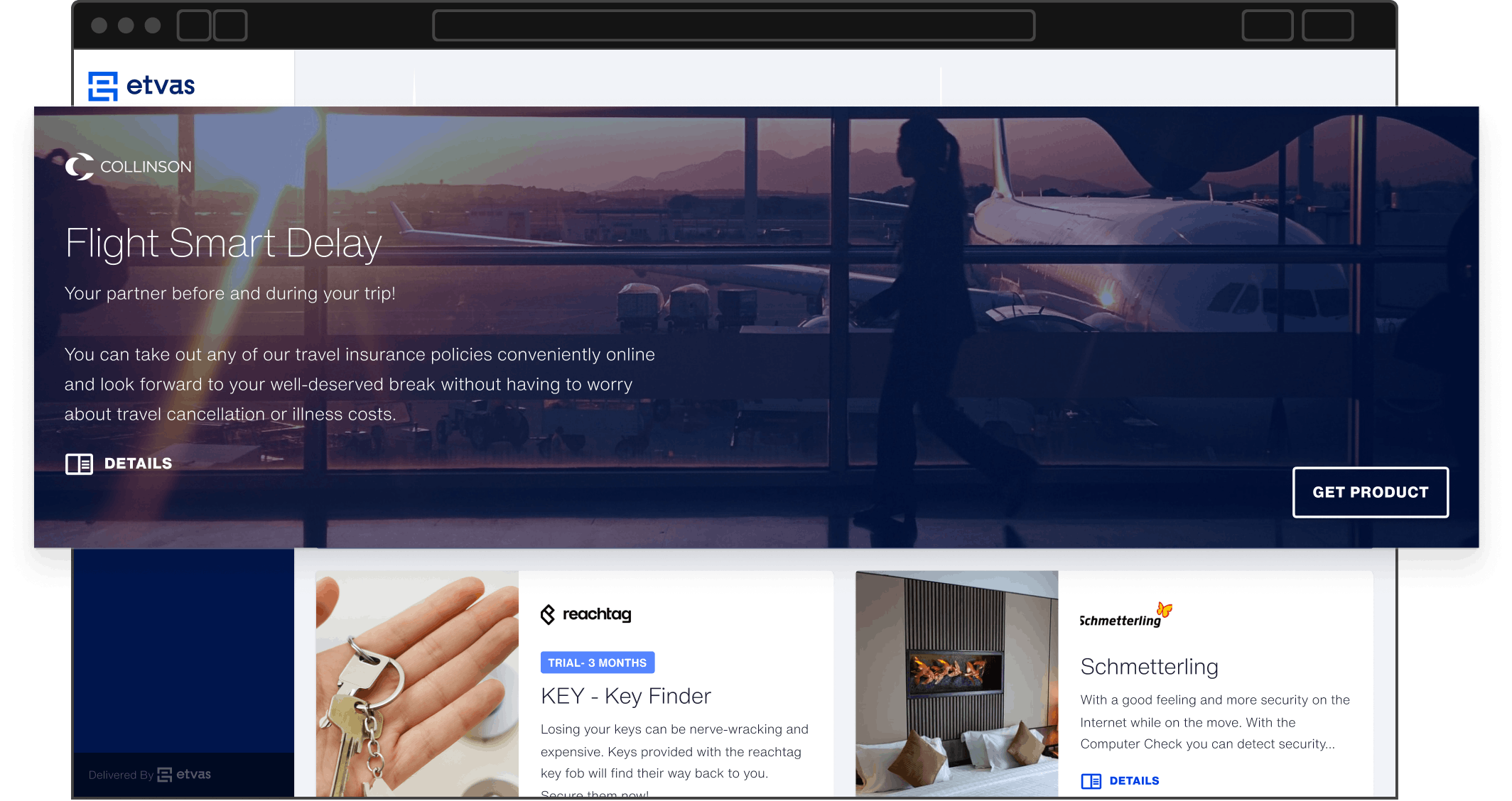

1. with the Etvas Whitelabel solution you are the fastest to market.

2. with full integration in your own online banking area, you ensure great customer experience through a consistent customer journey.

Cashback Offers need to be relevant to customers

- Generate no additional costs, just revenue without lengthy implementation efforts.

- Cleverly promote your brand as particularly customer-oriented by integrating relevant cashback offers into your online banking area

- Score points with your customers with consistent customer journeys. The entire process takes place in your online banking area. Your customers don't have to log in to an app or another platform.

- Simply add your own cashback offers to the existing portfolio in the Etvas partner portal.

- Your customers enjoy full flexibility because the payout is not dependent on any conditions (such as a certain minimum balance).

Take advantage of the cashback offers

Why Etvas Cashback Offers?

Innovative Cashback - What is this exactly? The Etvas technology!

We, the Etvas team, created the technology and partner network to offer your customers cashback promotions from cashback partners, such as retailers, service providers, etc., without access to Personally Identifiable Information (PII) or bank data. This benefits you as a bank, because you offer relevant cashback offers to your customers. You not only increase customer loyalty, but also your sales. The integration effort is minimal.

Our technical solution is not based on the typical affiliate marketing approach, but on AI and the associated precise targeting. Based on the transactions your customers have already made, we know their consumer behavior and avoid irrelevant coverage. Based on this, we only offer relevant cashback offers.

You are also not dependent on the online sales channel, unlike a regular affiliate program. Offer your customers both online and offline cashback promotions. It pays off! According to the latest Shopify study, 26% of all consumers are multichannel shoppers. Building customer relationships across all channels is virtually expected by consumers. The use of credit cards is also becoming more and more established as a popular means of payment in Germany, as reported by the Bundesbank. The credit card is the second most popular means of payment for online transactions. The Etvas Cashback technology is therefore based on all transaction data - regardless of whether your customer prefers a current account, credit card or debit card.

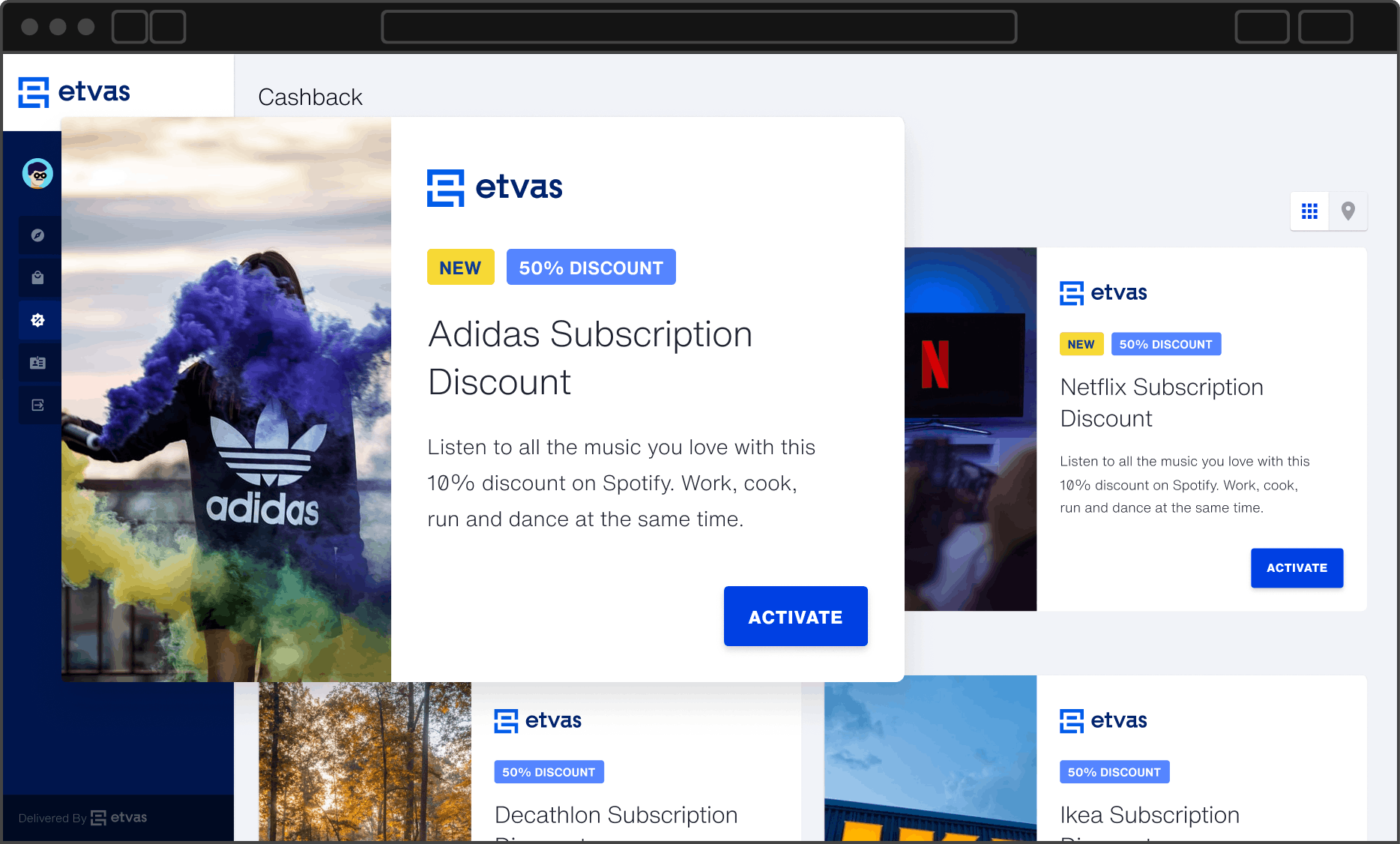

Our technology offers the most suitable deals based on transaction data

With our platform, cashback partners have the opportunity to create highly targeted cashback offers based on the customer's transaction profile. Just like Google or Meta (Facebook, Instagram, Whatsapp), the Etvas platform works with an attribution model. This way, rules can be set up to attract high-value customers. For example, a car-sharing provider can offer cashback to those who have spent a certain amount with a competitor in the last 12 months. This cashback offer can be valid for a certain period of time or indefinitely, depending on the wishes of the cashback partner.

Cashback - how does it work for Cashback Partners?

Banks and Investors trust Etvas

"The cooperation with Etvas enables us to make interesting and personalized additional services available conveniently via one platform - and at an attractive price."

Pranjal Kothari

Member of the Board of Managing Directors, Sparkasse Bremen

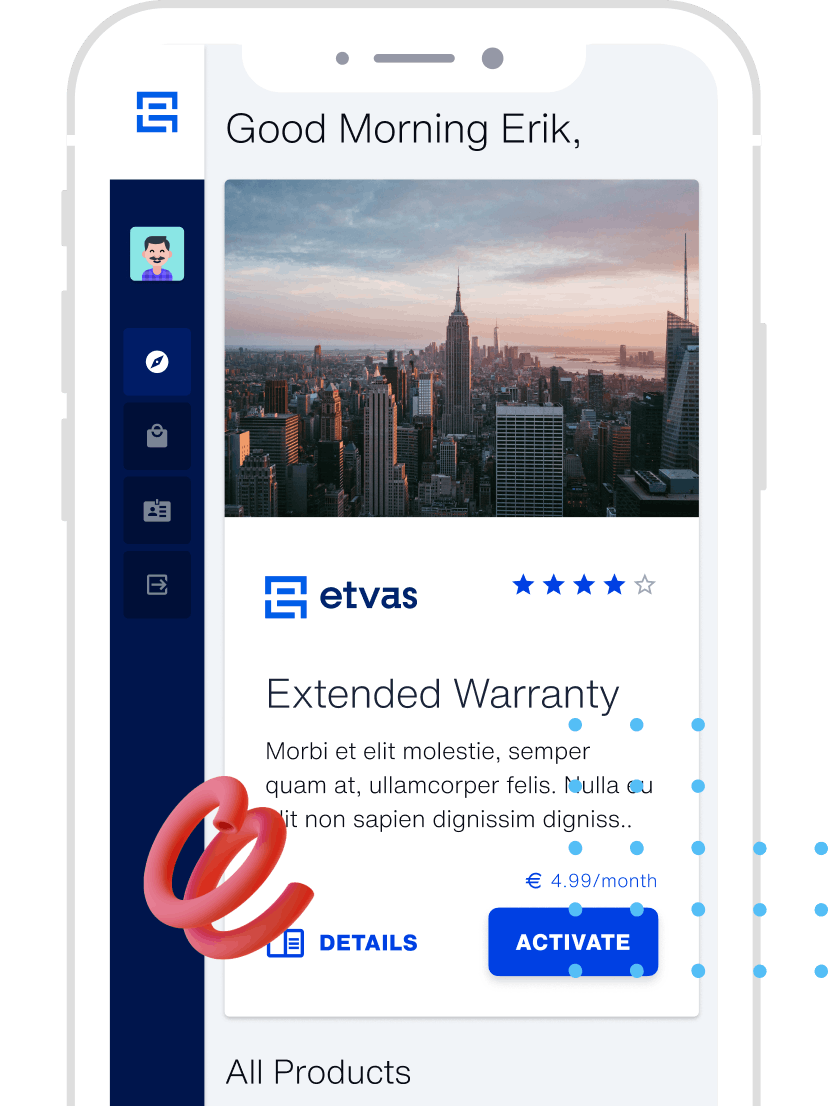

Only 2 steps and 1 click to higher customer retention and sales

At Etvas, we install a selection of cashback offers for you. Now it's your turn:

1. on our Etvas partner portal you check the selected cashback promotions and publish them with one click. Here on our portal you can easily remove cashback offers or add more at any time. Customer experience is something we feel strongly about. That's why our partner portal is designed to be especially customer-friendly and easy to use.

2. ask your customers to agree to the data processing. By activating the first offer, the customer agrees to the data processing of his transaction data. This allows us to offer transaction-based cashback offers and together ensure the relevance of the offers for your customers.