By using this website, you agree to our Cookie Policy.

Grow with card-linked Cashback:

Acquire new customers and delight existing ones

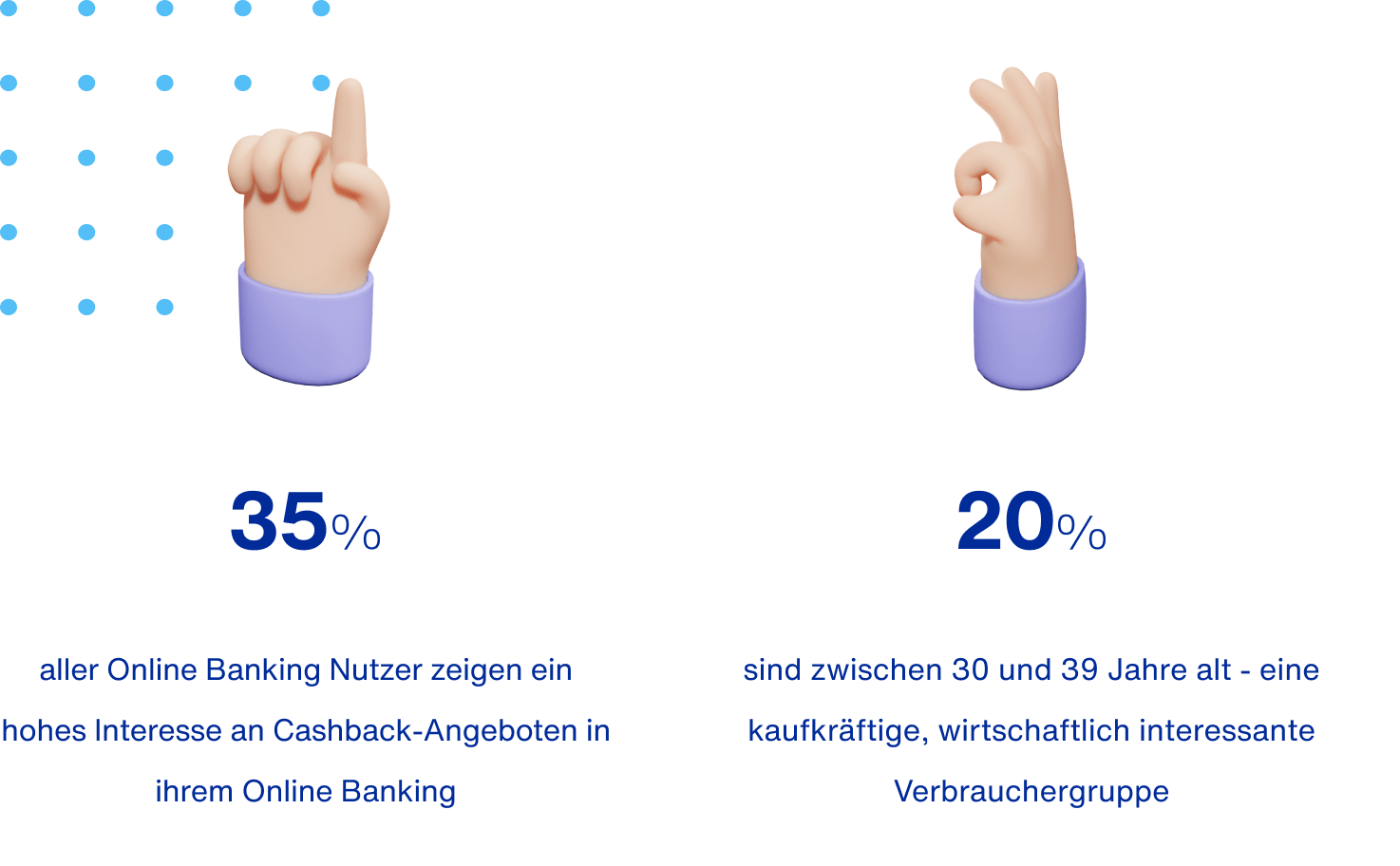

Win and reward customers in the online banking channel, as one in three consumers is interested in Cashback within their online banking application. 70% of users expect easy handling with just one click and no interruption to the shopping experience.

We support financial service providers in activating their customers with relevant offers and offering Cashback as a reward.

With our card-linked offers (CLO) reward platform, you can unlock additional revenue streams through increased transactions.

Most Cashback programs and promotions are unappealing:

• Irrelevant offers that do not reflect the interests of your customers

• Lack of active management and control of your Cashback promotions

• Customers struggling with technical barriers

• Significant reduction of your profit margin

Innovative Cashback - your new, effective marketing tool

Cashback is more popular than ever: online banking customers, especially males and millennials, show a high interest in Cashback. 40% of all online banking users would even use their debit/credit cards more frequently with Cashback incentives.

Prospective customers expect from Cashback offers in online banking: easy usability, such as activation with just one click without any additional steps during the payment process.

With Etvas Cashback, you target customers with high purchasing power

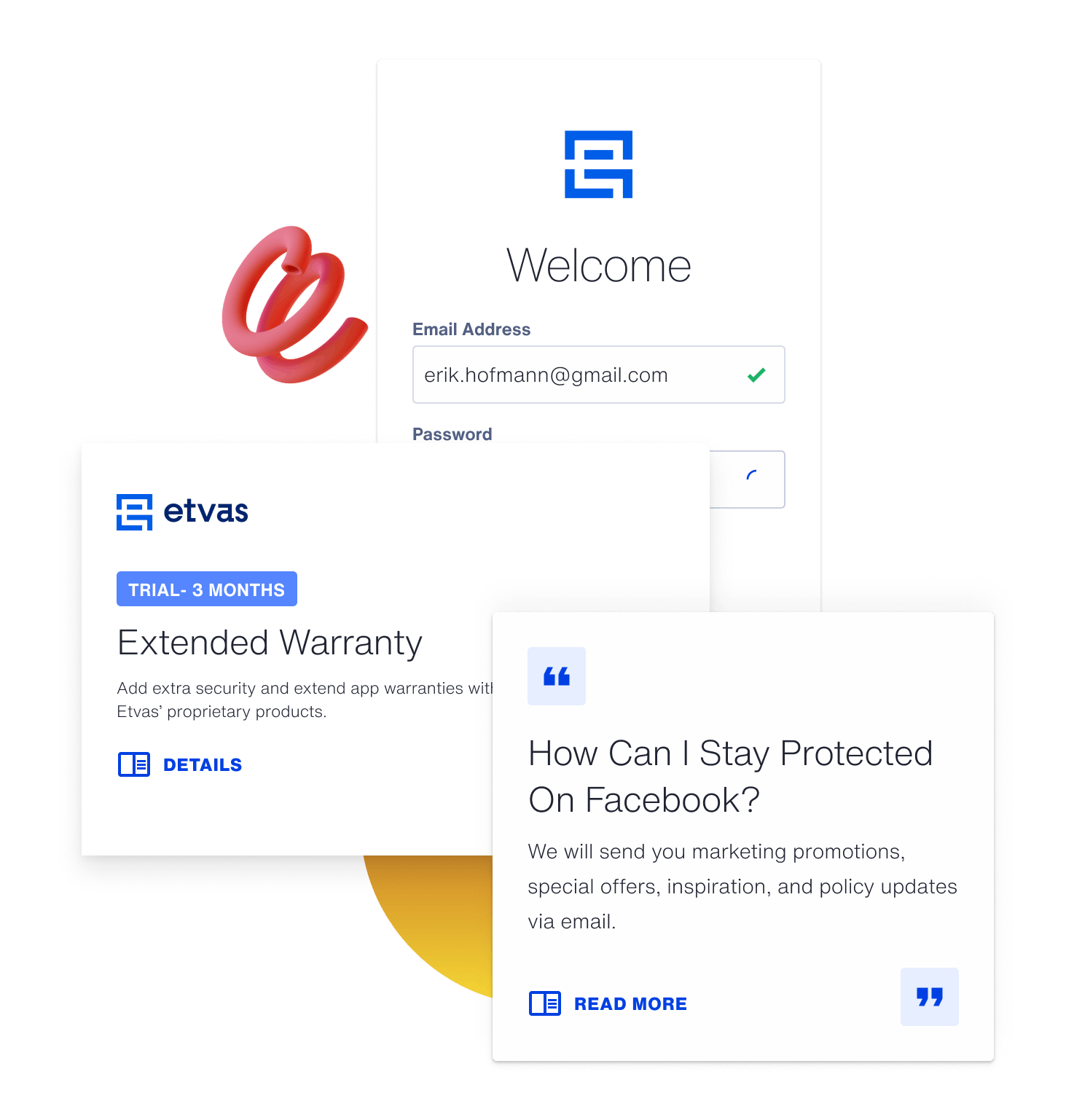

Reward your customers with the Etvas SaaS platform for card-linked offers. We match brands with your customers in their daily online banking applications based on anonymised card transaction data from online and point-of-sale payments. This allows you to offer targeted Cashback for online and offline purchases at the right moment: when consumers are engaging with their spending and savings opportunities.

Relax, as we make banking an experience

Deliver the best customer experience with relevant offers for your (new) customers. Get started quickly with:

• minimal implementation effort of just a few man days

• Integration into your own online banking: best user experience, high customer retention

Achieve your goals easily with our uncomplicated solutions

We ensure your growth with CLO through effective customer acquisition and retention

Gain a competitive advantage smartly

• With highly personalised offers in online banking.

• By accessing your customers' favorite brands.

• Through diversification: new Cashback offers await your customers every week

Increase your market share

• Acquire new customers with high customer lifetime value!

• Systematically activate valuable existing customers! Our flexible targeting options make it possible.

Focus on your core business

Save opportunity costs and allocate your IT resources to other projects! After the implementation is completed, we take care of maintenance and further software development:

• Our Reward Platform for card-linked offers is a reliable, stable, and scalable SaaS solution.

• Our legal text modules keep you on the right side of the law.

• We are available 24/7 for you and your customers.

Maintain the highest level of data security

• All transaction data remains within your banking environment. Personal data never leaves the bank.

• Our technology is "compliance checked". We operate in full compliance with GDPR regulations

Position yourself as your customers' best friend

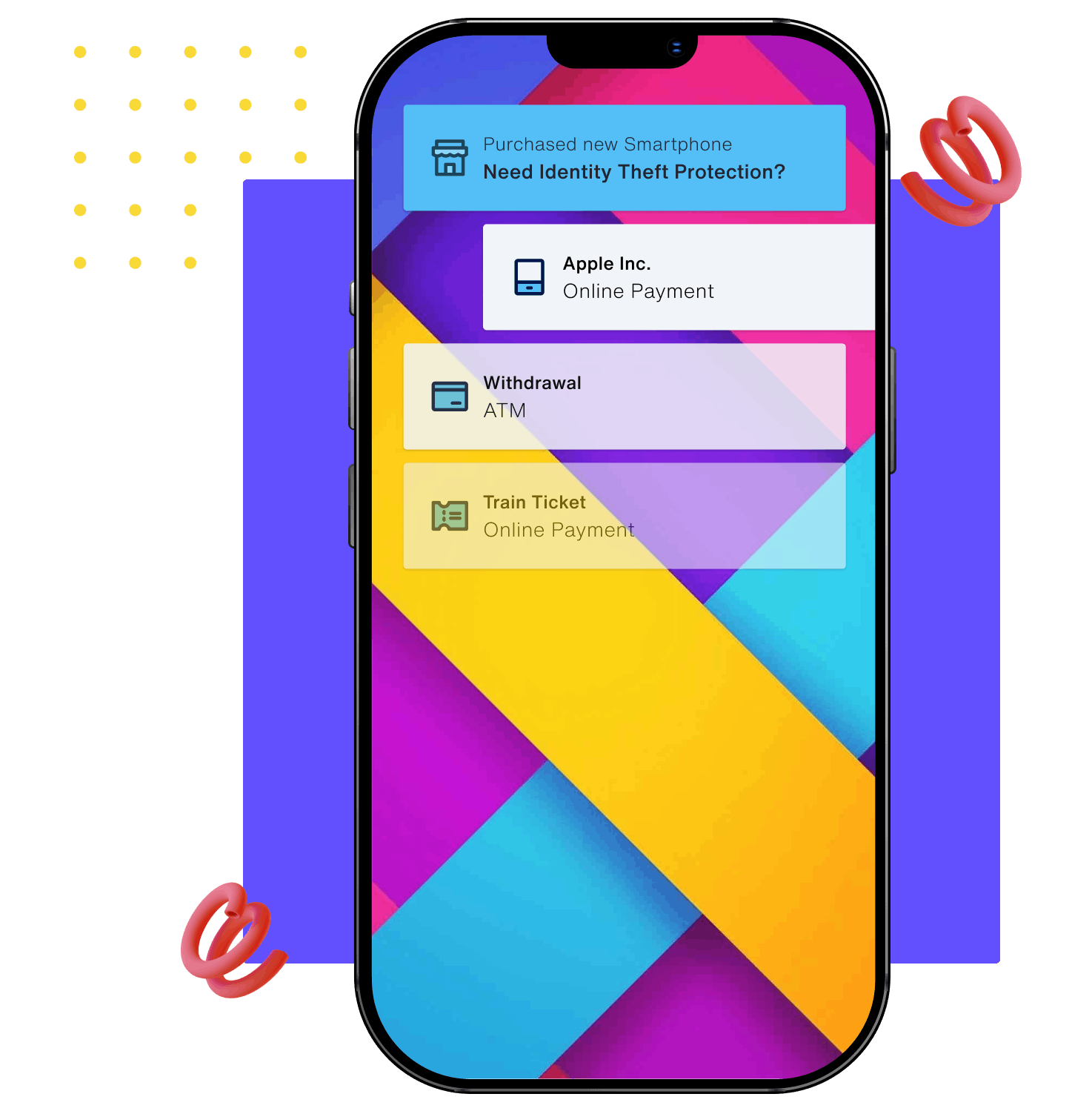

• Reward all your customers, as card-linked Cashback offers are channel-agnostic.

• Delight your customers by adding an emotional dimension to financial transactions with positive shopping experiences.

• Trigger true happiness in your customers with push notifications about earned Cashback.

• Create unique customer experiences! Your customers benefit with just one click. User-friendly functionality is important to 7 out of 10 online banking users

Your commercial benefits at a glance

Easily and quickly monetisable

• Acquire new customers & activate existing ones!

• Rapid market entry.

Positive business case

• Revenue sharing of 10% of the Cashback amount on utilised offers.

• Resource-efficient: developer friendly implementation, maintenance, and support.

Higher profit margin

• High customer retention leads to a higher customer lifetime value.

• Card-linked Cashback drives more card transactions and increases share of wallet.

Enrich our portfolio of banks that are successfully utilizing the Etvas Rewards Platform for card-linked offers.

"Etvas is an important strategic partner for us because they offer a unique technology in the German market. Through the Etvas platform, we enable parents to save sustainably for the future of their children with attractive Cashback offers. Saving becomes even more enjoyable."

Christina Hammer

CEO Co-Founder & CMO at Clanq

Little effort, big impact - always secure

Independent of the sales channel

Processing of all transaction data: debit and credit card payments. Reward all customers, whether online or offline shoppers.

Increased share of wallet

Precise targeting based on consumer spending behaviour ensures high relevancy of offers which increases your share of wallet.

Secure

The analysis of consumer behaviour excludes Personal Identifiable Information, ensuring compliance with GDPR regulations.

Great customer experiences

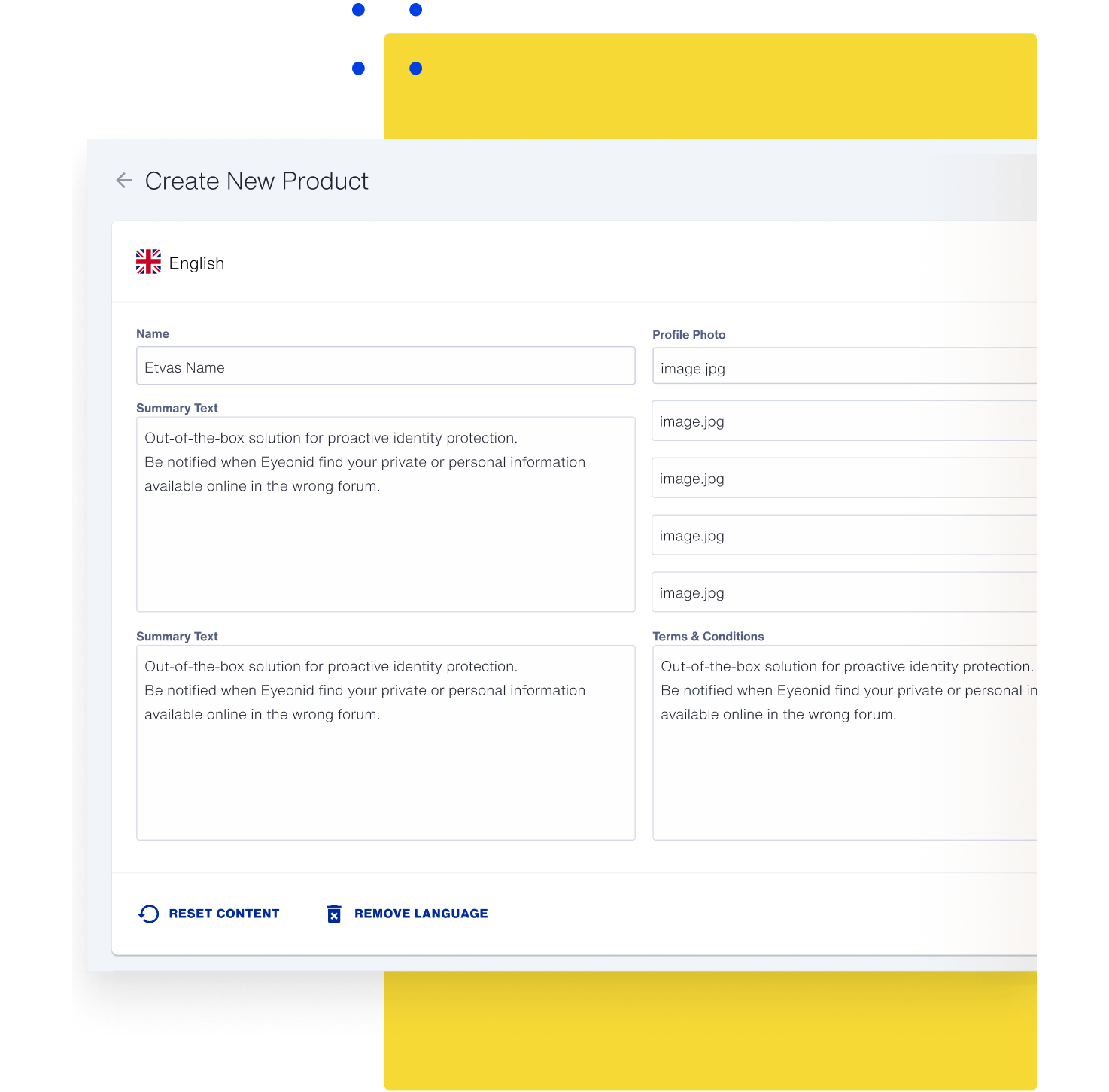

Diverse selection of carefully curated merchants: Scale your transaction volume with offers from brands that your customers love.

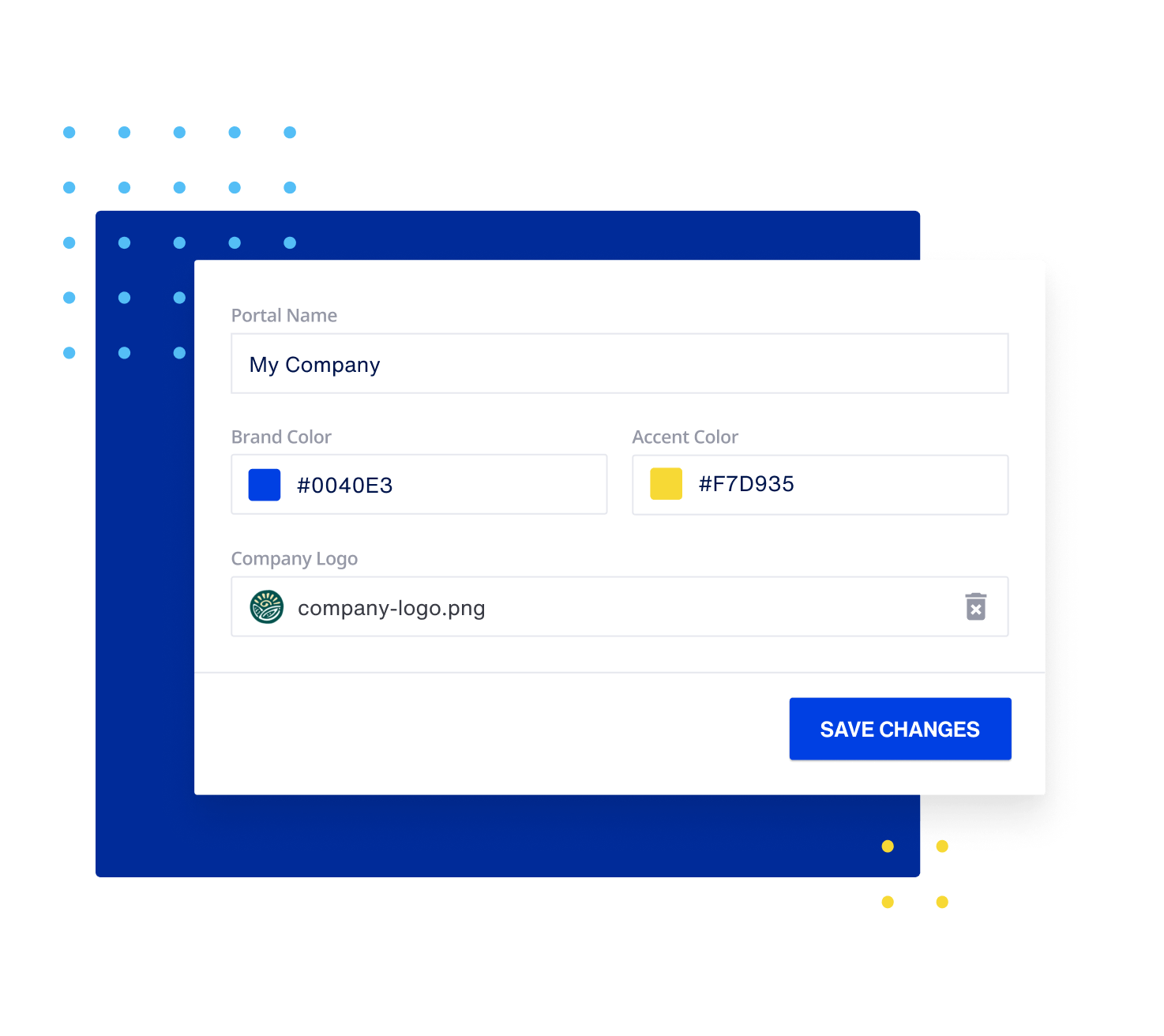

Highest level of customization

Choose suitable offers, their placement, and campaign durations yourself! Enjoy the highest level of flexibility and control at the same time.

Generate incremental revenues with our pricing model

More revenue

Additional income source: 10% revenue share based on Cashback amount.

Low costs

Fair set-up fee for implementation, low license fee

Scalable

Unlimited number of offers