By using this website, you agree to our Cookie Policy.

That's how Cashback works today:

In a new, secure channel with unique targeting technology.

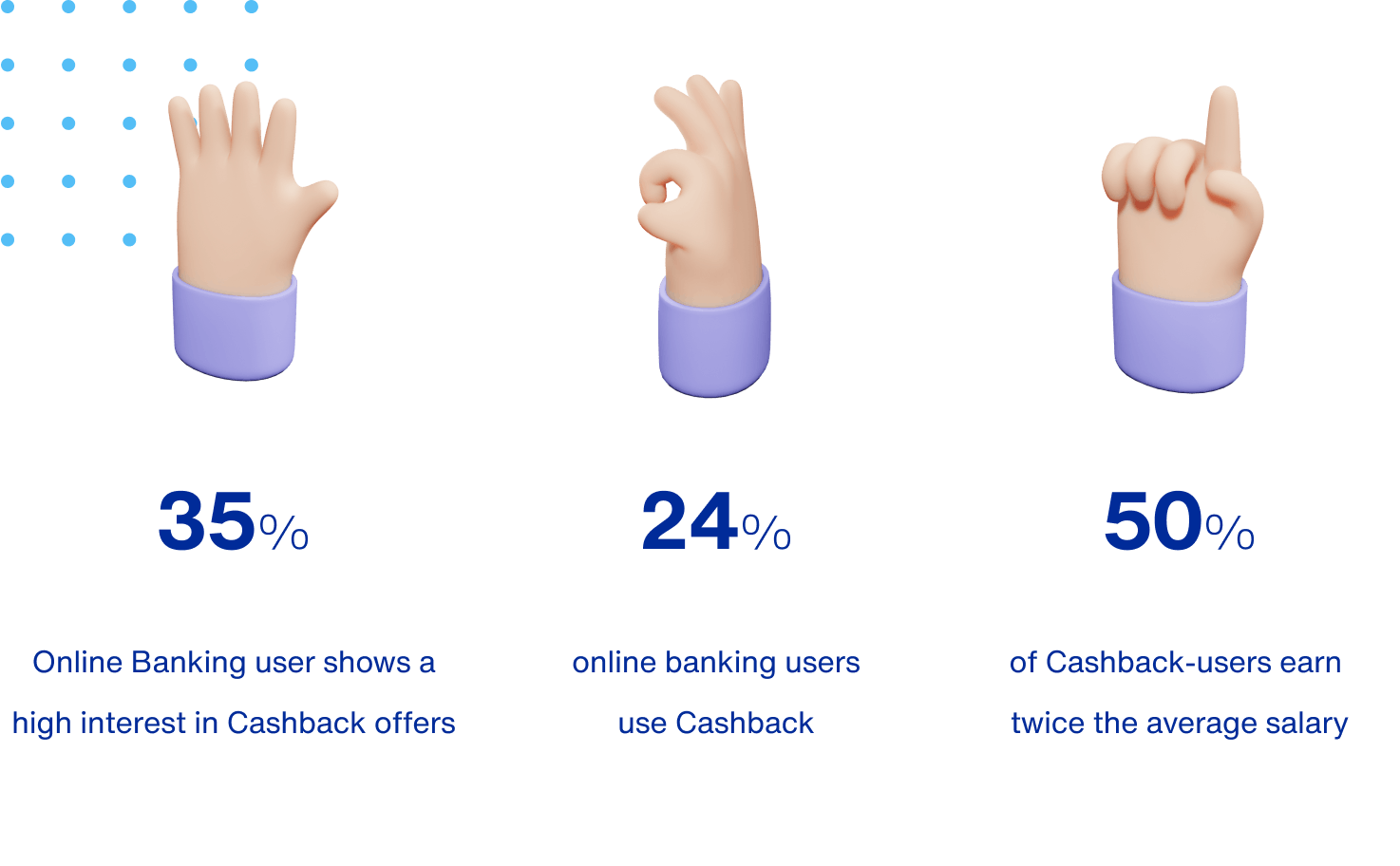

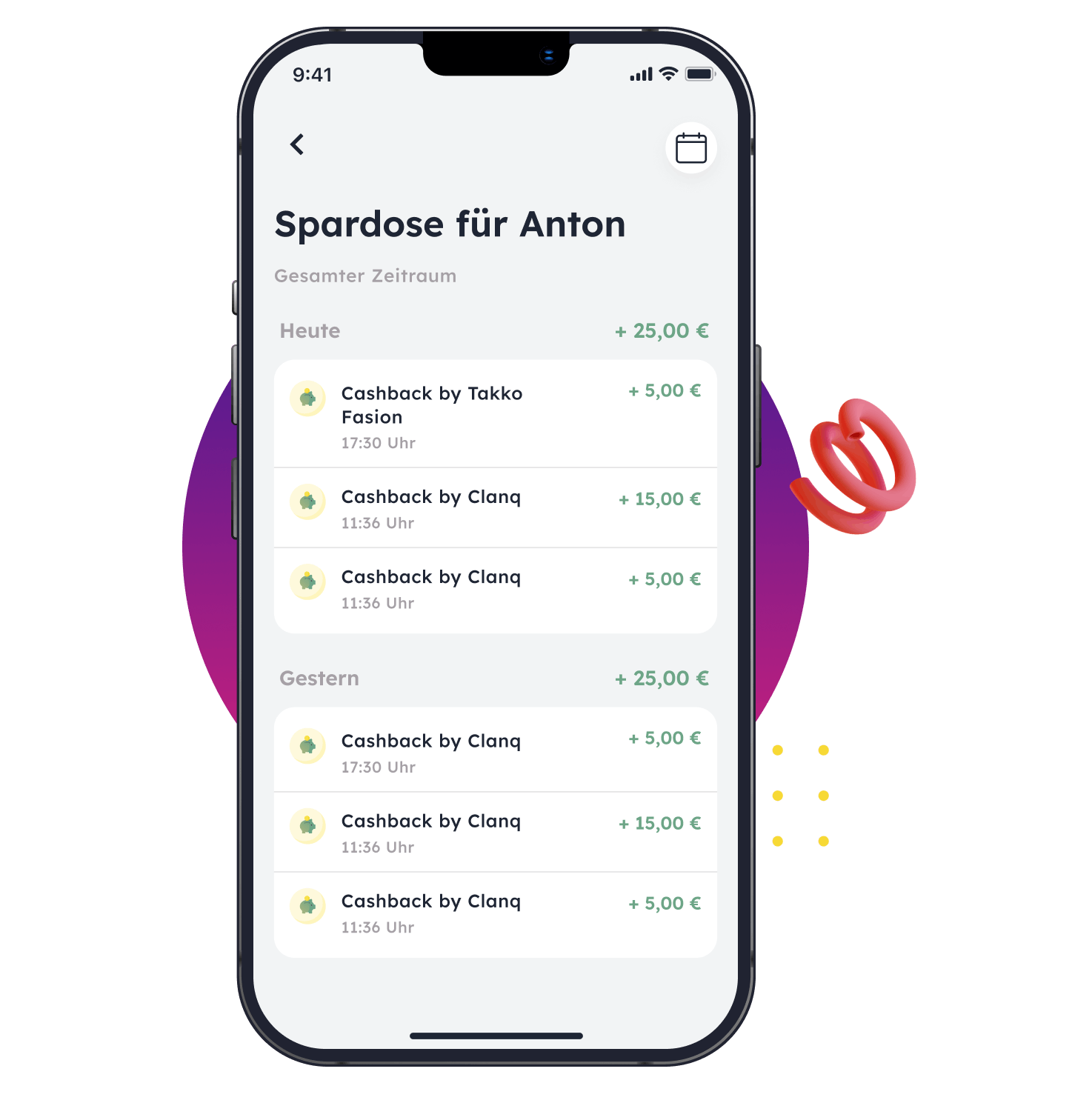

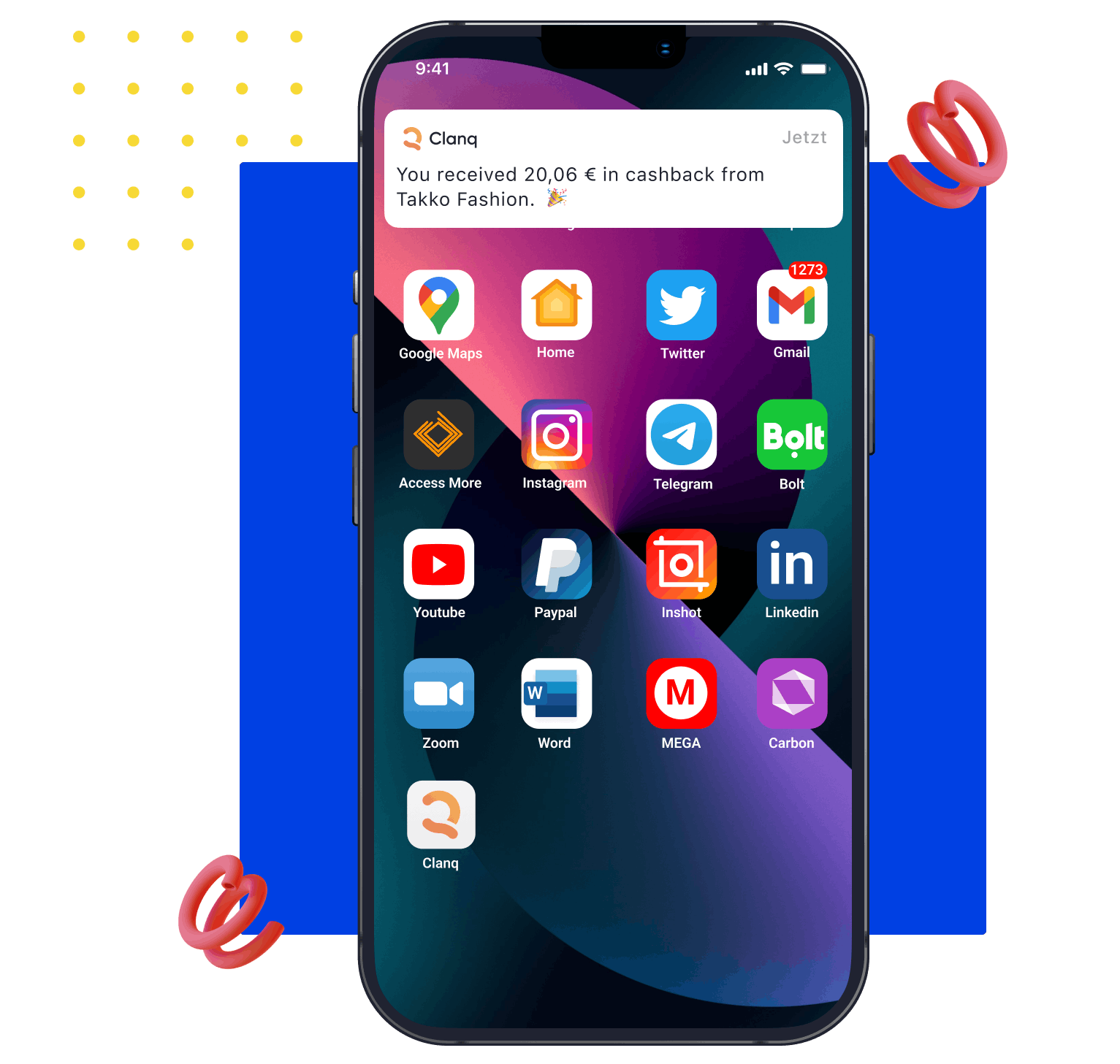

Win and reward customers in the online banking channel as one in three consumers is interested in Cashback in their online banking application. 70% of users expect easy handling with just one click and no interruption of the shopping experience.

We help brands to win and retain high-value customers by opening up a new and exciting marketing channel through banks.

High conversion rates combined with low cost per acquisition (CPA) result in revenue growth for both digital and brick-and-mortar retailers.

Acquiring and retaining loyal, new customers in competitive markets can be challenging:

• High-reach advertising is expensive

• Increasing banner blindness

• High scatter loss due to inefficient targeting

• Complex or limited control over ad placements

• Fleeting campaign effects: customers make one-time purchases

• Resource-intensive brand awareness measurement

• Inaccurate success measurement due to "end of cookies" challenges

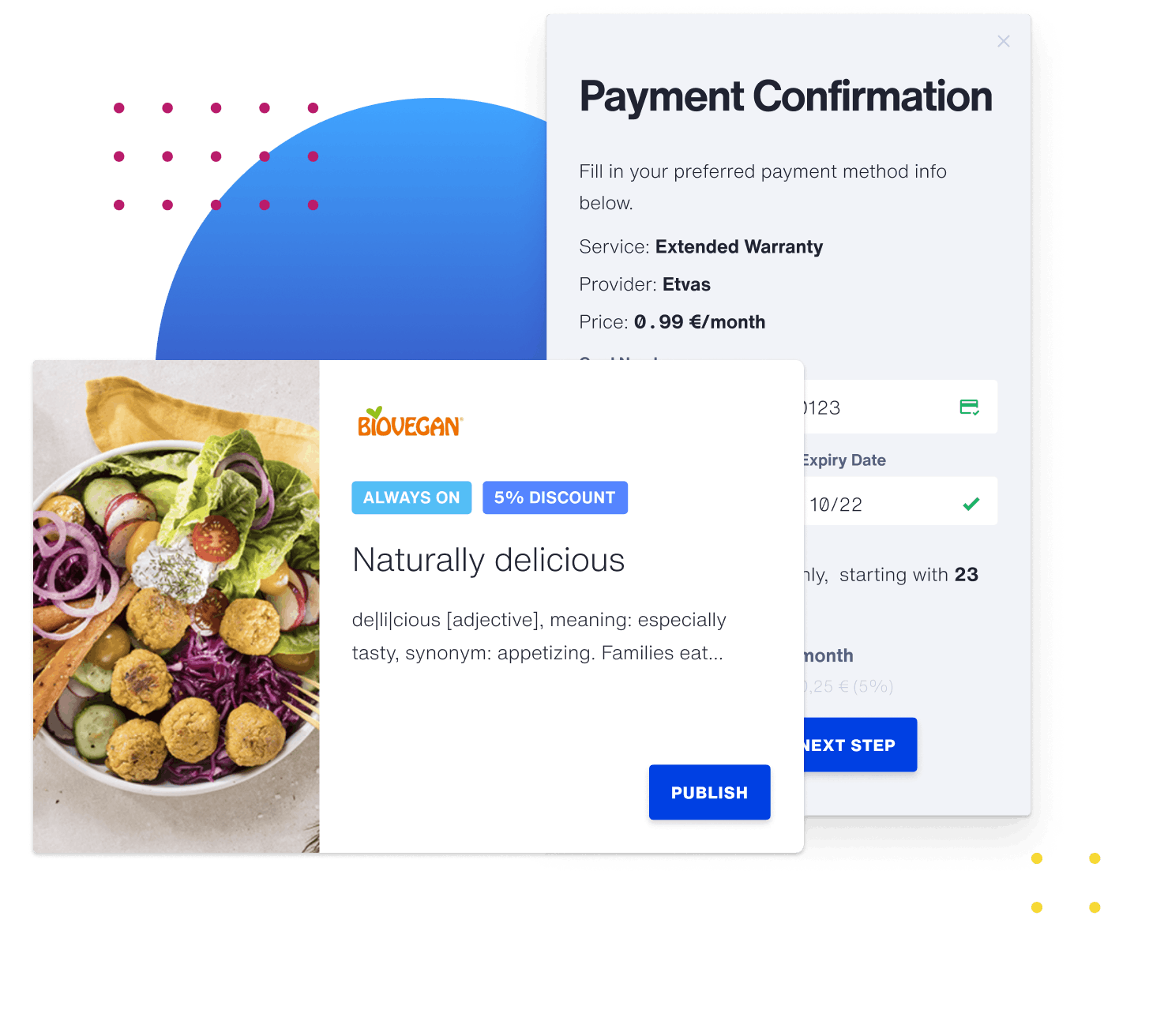

Innovative card-linked Cashback: Your new, effective advertising format

Indeed, the search for Cashback offers has increased significantly since May 2022, driven by rising inflation rates. Cashback is easily understood by everyone, unlike points or rewards, as the reward can be used freely. No waiting time for point thresholds or specific items.

Cashback customers are a financially empowered target audience, with Millennials particularly enjoying Cashback as a form of reward. Furthermore, users of online banking platforms show a high interest in Cashback offers within their banking applications.

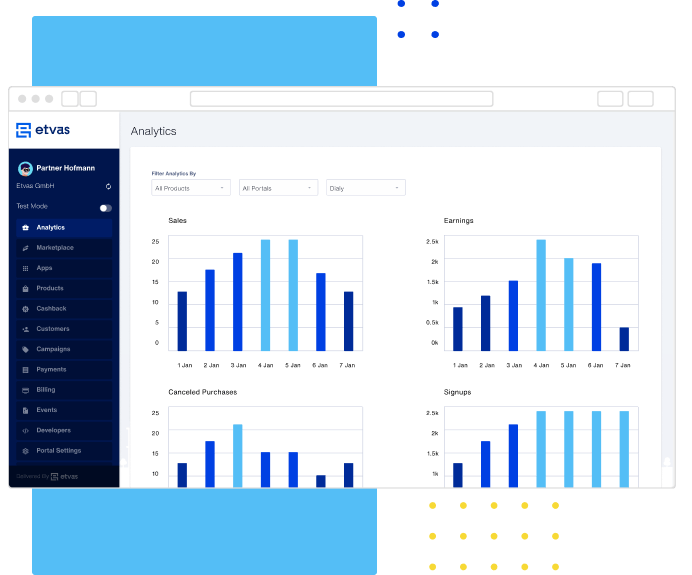

With etvas card-linked Cashback, you can reach profitable customers

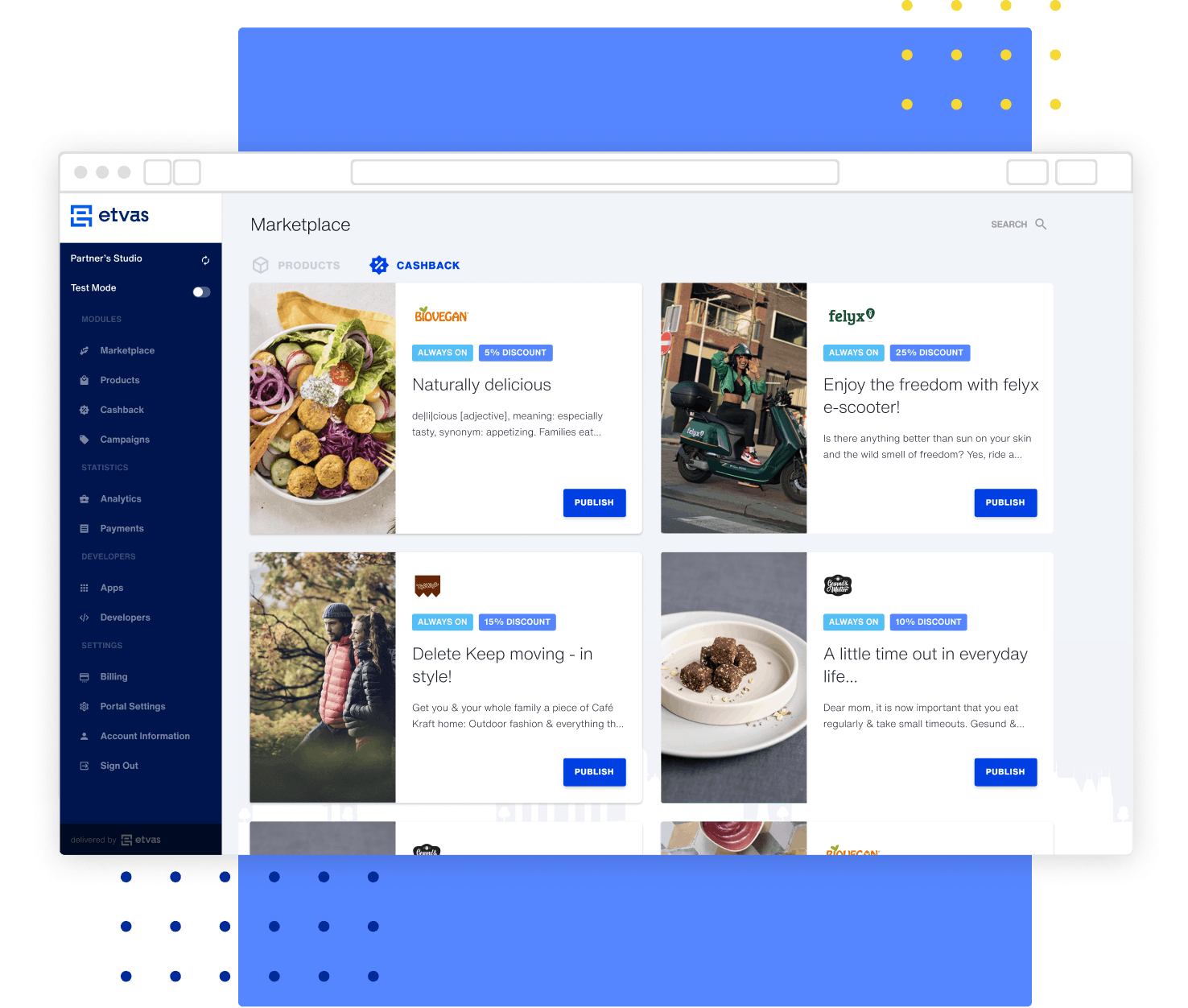

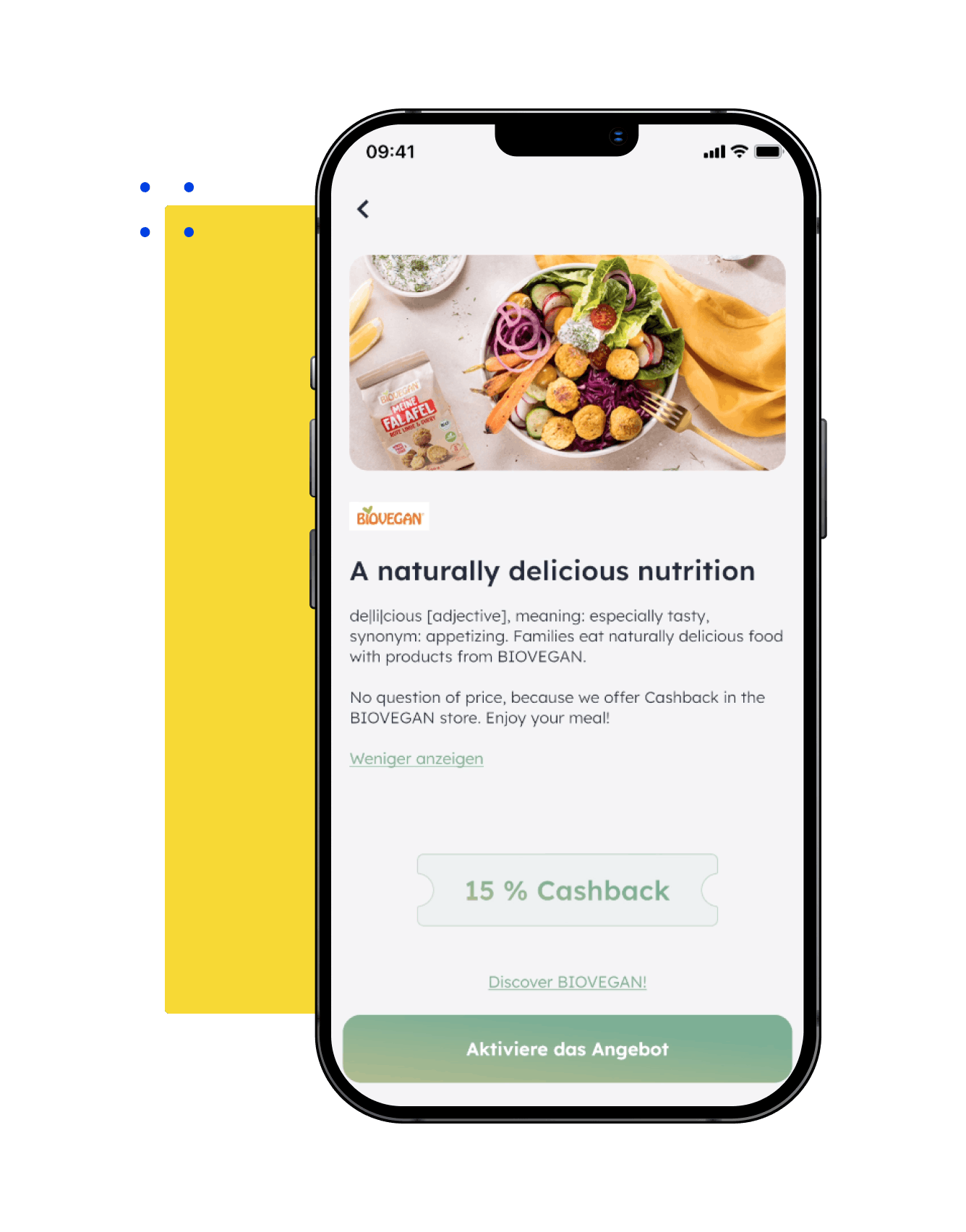

Reward your customers with Cashback through the Etvas SaaS platform for card-linked offers. We match brands with online banking users based on anonymised card transaction data that reflects their purchasing behaviour. This results in high conversion likelihood. Whether they shop online or at the point of sale, with Etvas Cashback, we target interested customers with relevant offers. Your Cashback offers are displayed in a privacy-compliant manner within the secure environment of online banking.

We ensure your growth - without cookies

Win and reward customers quickly. No implementation is required. You simply register on our Etvas platform.

We also provide support with crafting offer texts, Cashback amounts, and creating visual materials.

Reach more customers with just a few clicks

Reward your customers precisely online and offline in the banking channel

• Revolutionise your marketing mix with Etvas' purchase intelligence.

• Utilise a new, unique targeting approach based on consumer purchase behaviour.

• Minimise your scatter losses and reach interested prospects and customers.

• Offer tangible savings on beloved brands through Cashack.

• Pay higher Cashbacks and delight your customer base.

• Build your positive brand image through exceptional purchasing experiences.

• Leave traditional affiliate marketing behind and explore new possibilities.

Offer something new to your customers, regardless of the sales channel

Secure exclusive access to customers in the digital channels of banks, financial service providers, and fintechs. Reach new and existing customers for increased growth.

The banking channel offers low competition, targeting consumers at the "moment of truth" - they are engaged with their income and expenses. Compared to traditional display ad networks, you'll benefit from:

• Free impressions and clicks

• Higher conversion rates

• Performance-based payment model: Pay-per-Transaction.

Leverage a new, effective marketing channel

Leverage the opportunity to generate a multitude of additional touch points:

• Reach potentially 42 million German consumers.

• 6.5 billion card transactions counted in Germany 2020. Trending upwards: +24.9% in 2021.

• On average, each German consumer owns 1.9 cards.

With card-linked marketing campaigns, you can achieve astonishing KPI's.

Discover the potential of highly relevant and precise campaigns

Be among the first in the German market to unlock the potential of highly targeted campaigns based on transaction data. With the unique Etvas SaaS platform for card-linked offers.

Increase in revenue

Win customers with high CLV! Increase customer satisfaction & loyalty.

Higher profit margins

Higher profit margins through a high Customer Lifetime Value.

Precise targeting

Full flexibility in targeting: order quantity, order value, specific time period, and more.

Great customer experiences

Best UX for your customers with just 1 click, no tracking link required.

Optimal ad placement

Offer control via dashboard and A/B tests. Placement in secure online banking environment.

Fair billing model

Effective budget utilisation: Pay-per-transaction, free brand awareness.

Personal Support

Intuitive self-service or support from our customer success manager.

Free trial

No risk, but great opportunity: free trial before scaling.

Here are your commercial benefits at a glance

Revenue Growth

Increased brand awareness and larger customer base - leading to higher revenue.

Higher profit margin

Higher profit margins achieved through a higher customer lifetime value.

High conversion rates

High conversion rates, high ROAS with low CPA. Only pay for real customers.

Start immediately

No implementation required: Rapid market entry.

Enrich our portfolio with brands successfully using card-linked Cashback offers

"Etvas allows us to diversify our growth marketing efforts with minimal effort and tap into new customer segments. The Cashback technology also has the benefit of only paying for relevant traffic and provides us with well-controlled return on ad spend (ROAS)."

Christopher Eisermann

Brand Manager Germany, Felyx

Our Cashback solution at a glance

Unique targeting

Free trial period

SaaS: No installation required

Success-based payment model

No cookies required

Analytics & Market Insights

Self-Service + Success Manager

Positive brand experiences

Our fair pricing model

Free trial

Free, no-obligation testing phase

Exclusivity

Exclusivity for the first partner in their category

Fair billing model

CPA (Cost Per Acquisition) = Cashback amount + 20% of the paid-out Cashback

Unlimited offers

Any number of offers

One license for all

Unlimited number of users

Risk-free

No fees

No cancellation periods