Protection against hacker attacks and data espionage: one in two customers would use similar offers from their bank

Security services are particularly popular with young Germans

As value-added services become part of banks’ and insurance companies’ innovation strategies throughout the world, some ecosystems tend to weigh more than others. We’ve recently teamed up with Civey to analyse German customers’ preferences with regards to value-added services in general, and we more recently took a closer look at specific service ecosystems. The study was conducted on behalf of Etvas GmbH, on more than 5,000 German citizens.

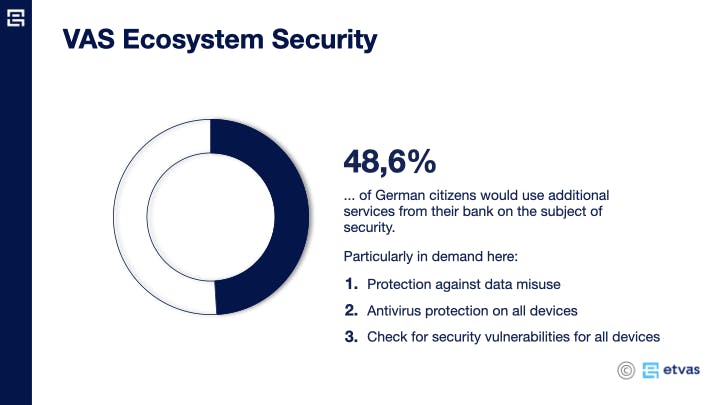

German citizens have a strong desire to move risk-free in the digital world. Almost every second person is open to using security services offered by their bank or insurance company. When it comes to handling personal data, banks continue to enjoy a high level of trust among citizens.

However, German citizens are increasingly afraid of data misuse. "People are looking for offers to close security gaps on their own devices and protect themselves from hacking and data espionage," says Sören Timm, co-founder and CEO of Etvas. "This is an opportunity for banks to open up new business areas with suitable value-added services. As banks are usually bound to apply the highest security requirements throughout their entire activity, customers particularly trust them in this field."

Maintaining a strong connection to the customer with more value-added services

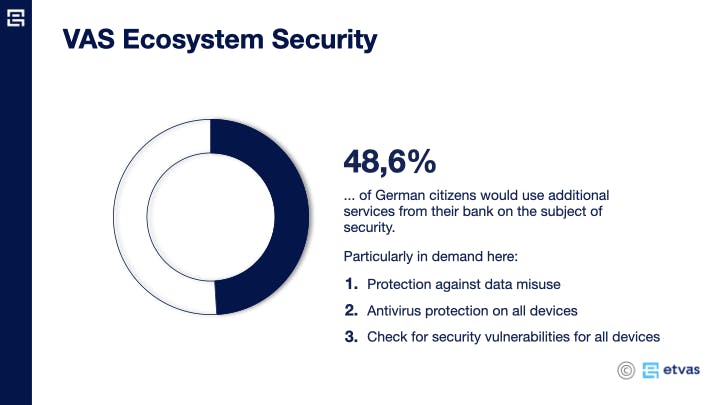

Around 30 percent of customers would be willing to book a service through their bank that protects their data from misuse, for fear of identity theft. One in four people would be interested in an anti-virus protection software offered to them as an extra service by the financial services provider. And nearly one in five would use a service that scans all their devices for security vulnerabilities to detect data leaks. Etvas CEO- Timm: "As service providers, banks can go beyond their traditional business and expand their contact with customers, which they are currently in danger of losing due to IT corporations, fintechs or neobanks."

Young people up to the age of 30 are particularly willing to use such services. They spend many hours a day in the virtual world and want to control the traces they leave behind. Two-thirds of this group are therefore interested in security services offered via their bank. "This is a good opportunity to score points with these customers of the future," says Timm.

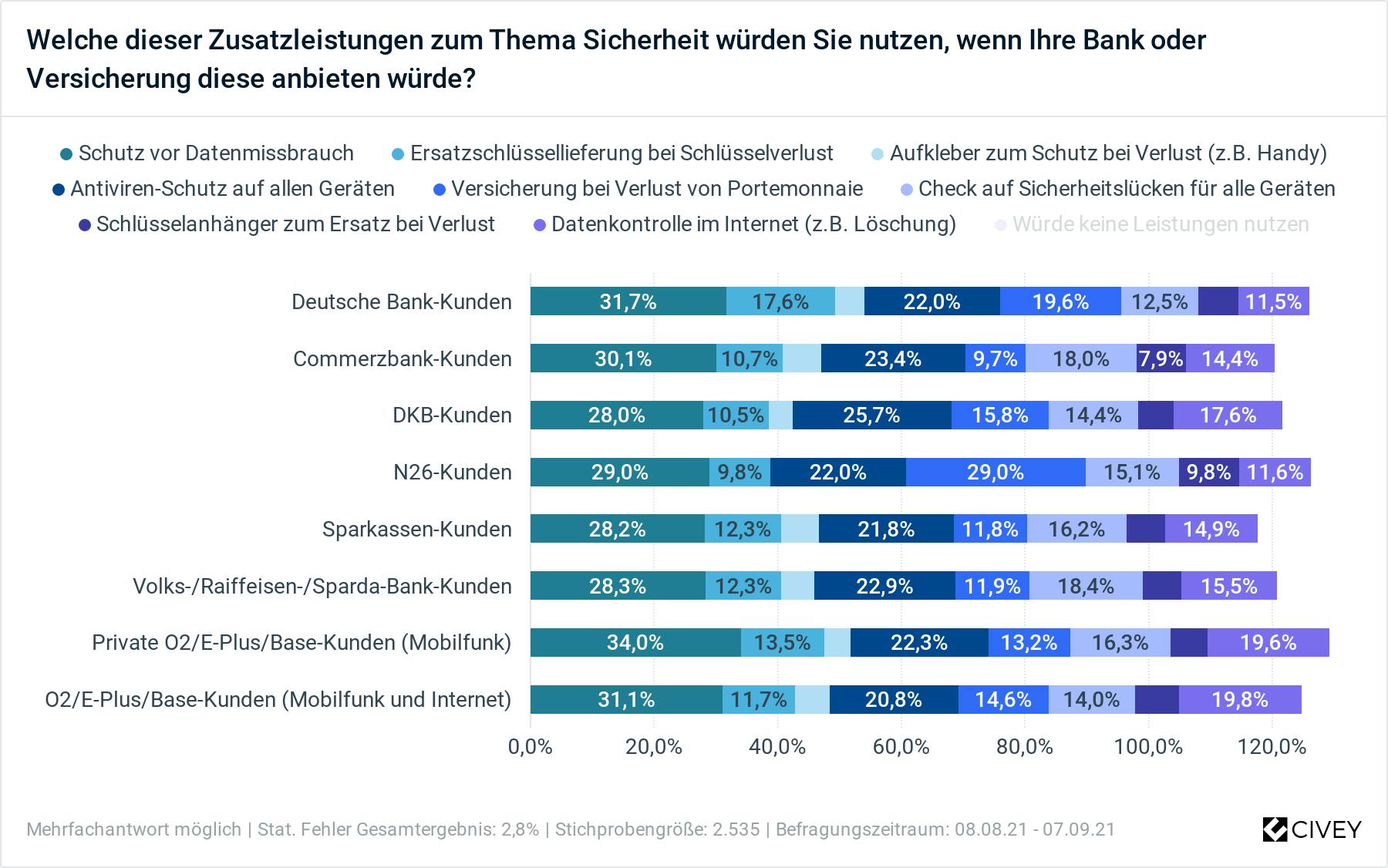

Additional services instead of fee reimbursement

And such services have yet another advantage for banks. "They are a way to compensate for account fees," the Etvas founder is convinced. After all, following the Federal Court of Justice's ruling on invalid general terms and conditions clauses of financial institutions, millions of customers can claim back fees they have overpaid. But instead of the money, for more than every second customer, a higher-value product from his bank is also an option, as the current survey shows.

Conclusion

Customer centricity, end-to-end process digitization, and ESG stand out as the top three agenda items for decision makers in German banking, states a recent McKinsey study.

When looking to increase customer satisfaction and loyalty, banks and insurance companies need to look closely at customers’ preferences, as well as assess their particular life events. It’s the only way they can stay relevant in times when huge portions of the market are shifting to more attractive offers from newer suppliers.